The underwriting process is critical to long-term profitability for an insurance business. Underwriters evaluate an applicant’s risk and determine the ideal premium quote for the consumer or business.

Some insurance products involve simpler processes based on just five to seven data points. But many other products are far more complex. The challenge in these situations is accessing comprehensive and effective data to determine the most accurate price.

The Important Role of Underwriting

Over time, data is collected on risks posed by applicants based on certain traits or behaviors. For instance, auto insurance assessment considers factors such as car type, years of having a drivers license, and location, which have a relatively strong correlation with accident and claims rates. The greater the risks posed by an applicant, the higher the technical price an underwriter will apply to offset the risks and preserve profitability for the business.

Underwriters must also consider the need to attract applicants with competitive rates – or the so-called market price. If your quotes are too high, you will lose prospects to providers with lower rates. The sweet spot for pricing lies in striking a balance between the technical price and market price.

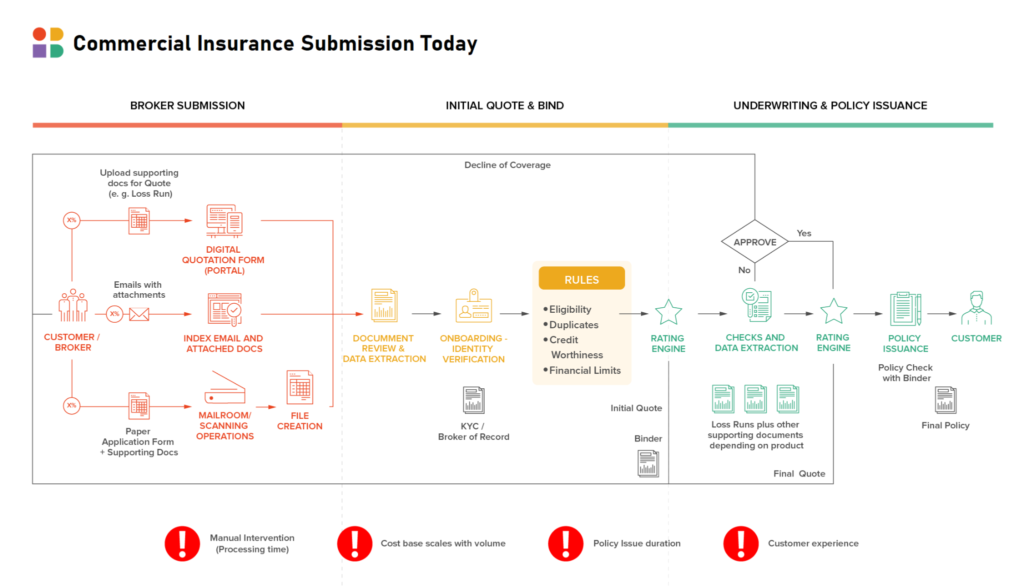

Historically, much of the underwriting process has been manual. Underwriters relied on their ability to manually assess data to choose the right premium. Today, rating engines are used to help the underwriter to determine the appropriate premium; for simpler products this can be a fully automated process. However, significant manual assessment is still required for more complex insurance products in commercial, specialty, and more complex life insurance products. Find an example of a commercial insurance submission process below. The variability and complexity of the documents underpinning these submissions are simply too high for traditional technologies such as RPA or OCR to process.

Trends in Underwriting

There are two critical trends impacting the insurance underwriting process in the modern era, which are speed of assessment and efforts to better leverage data to understand risk.

Speed and Customer Centricity

Increased competition puts more pressure on insurers to operate efficiently and with a customer-centric approach. Insurance is an extremely competitive financial sector. Customer expectations for rapid responses from insurers continue to rise in the digital age. This equally applies to brokers. Faster and better responses to brokers will help create a better business relationship.

It is much easier to turn around quotes on simpler insurance products due to more limited data requirements and efficient use of technology. However, more complex products like whole life and commercial policies present greater challenges for timely and accurate pricing.

Availability of Data for Risk Assessment

Effective underwriting is heavily dependent on accessible, accurate, and comprehensive data. With simpler products, it is easier for underwriters to gather data and run it through their ratings engine to generate a premium.

The data for more complex products is more difficult to attain. Often, underwriters ask for additional data and documentation from applicants. An example is a medical record for a life insurance application. Commercial underwriters also receive submissions from brokers, which are packages with multiple documents including broker presentations, loss runs, and schedules of value.

All these documents are unstructured and highly variable, which hampers the ability of underwriters to efficiently access the data they need for the most accurate risk assessment.

In addition, insurers are only using a fraction of the data contained in these documents. For continuous transformation, new pricing models need to be developed that leverage far more data contained in submission packages and medical records.

Leverage Automation for Speedy and Accurate Underwriting

To optimize speed and accuracy in risk assessment, you must grasp the full scope of rich data from the documents received. Doing so allows you to earn more business by beating competitors to the market, while balancing profitable considerations for the business. Moreover, extracting more data from these rich documents – data the insurer already has – allows the insurer to populate data lakes for data science purposes such as the development of better pricing models.

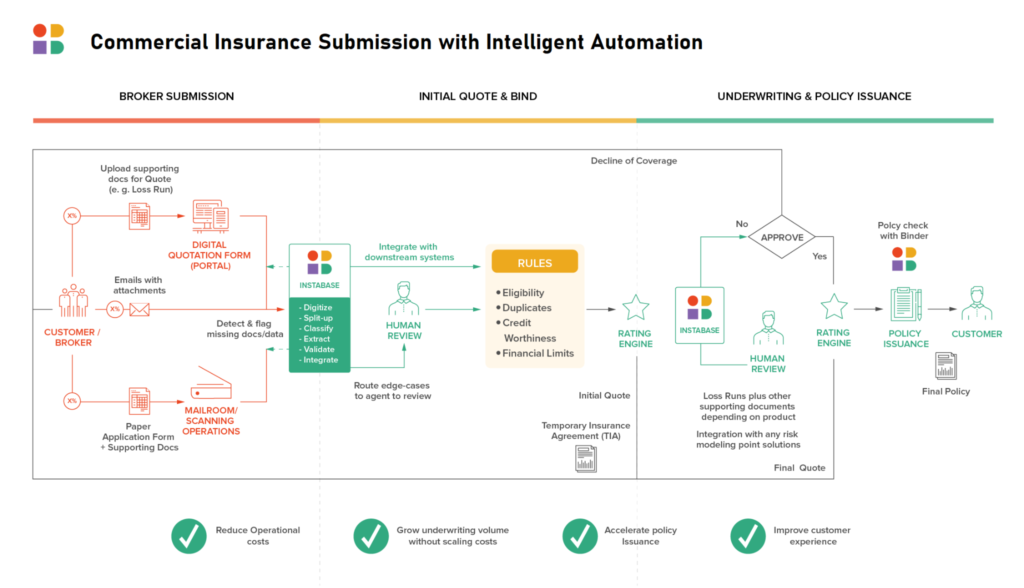

Instabase, the Automation Platform for Unstructured Data, is designed to address exactly these challenges. It leverages deep-learning capabilities that enable the extraction of unstructured, variable data for conversion into structured, usable data.

The following are some of the key advantages insurers receive from intelligent document processing through Instabase:

- Faster Extraction: Currently, most insurers rely on manual interpretation of data by talented professionals when handling complex products. Manual assessments take time, especially when the underwriter has to request more documentation. Automated document processing speeds up data extraction and enables underwriters to more efficiently leverage the data for risk assessment.

- Greater Accuracy: Manual processes are always more prone to error than effective automated solutions. Instabase maintains very high rates of accuracy in pulling useful data from unstructured, complex documents.

- Heightened Operational Capacity: The insurance sector faces a significant talent gap with underwriters. Veteran underwriters are retiring or nearing retirement. The pool of qualified candidates entering the field is diminishing. By leveraging automated document processing, businesses can do more with less. Underwriters gain access to comprehensive, structured data much more quickly, which allows them the time needed to use their expertise to discern the influence of other qualitative factors and hone the price range in the final premium quote.

- Increased Market Share: The ultimate goal of insurers is to grow market share for a sustainable, profitable business. By leveraging Instabase technology, you can meet the demands for speed and accuracy from the market. Improvements in operational capacity allow you to effectively evaluate more applications than competitors, improving your chances of winning more clients.

- Continuing Transformation: Insurers are in a constant battle to better understand risk and price it better. Mining documents you already have for higher quality data is an easy win that provides insurers with a way to build their data lakes for advanced price modeling, predictive analytics, and other data science purposes.

Transform Underwriting with Instabase

Commercial lines markets continue to benefit from hard pricing and demand remains high. With the rising interest rates, demand for life insurance products is on the rise as well.

With an increase in demand, and a continuing tight labor market, the demand for more processing capacity per underwriter is higher than ever. In parallel, the demand for more data continues to be a defining factor for developing ever more sophisticated pricing models.

The solution for insurers is deep-learning automation that equips them with comprehensive, structured and useful data. Instabase powers more advanced data-science modeling. Refine your risk assessment and pricing through improved algorithms and more time for underwriters to fine-tune quotes.

See how the Instabase Automation Platform for Unstructured Data works today.

Transform underwriting with automation.

Tap into unstructured data with Instabase.