Intelligent document processing has become a pressing need for investor services in recent years. Providers face significant challenges inherent in large volumes of unstructured data related to onboarding and KYC compliance, investment documents, and regulatory reporting.

Historically, providers have managed the extraction and processing of complex data manually. However, leading investor services providers recognize the efficiency, data insight, and security benefits possible when automating critical business processes with intelligent document processing. The key is to find a solution that is both accurate and efficient.

The following is a look at how Instabase offers compelling advantages in three key areas:

- Onboarding and KYC

- Investment documents

- Regulatory reporting

Onboarding and KYC

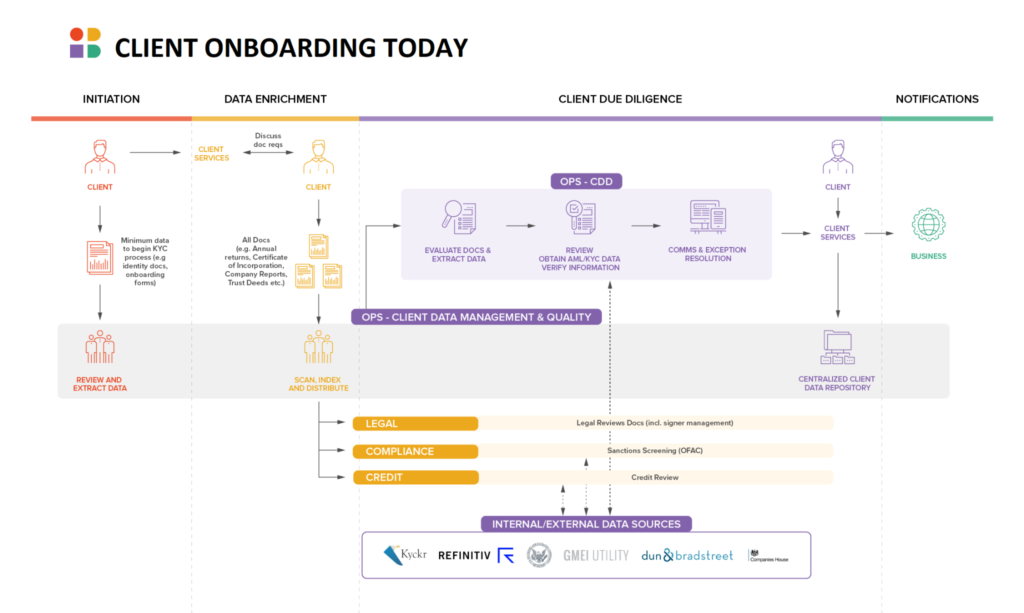

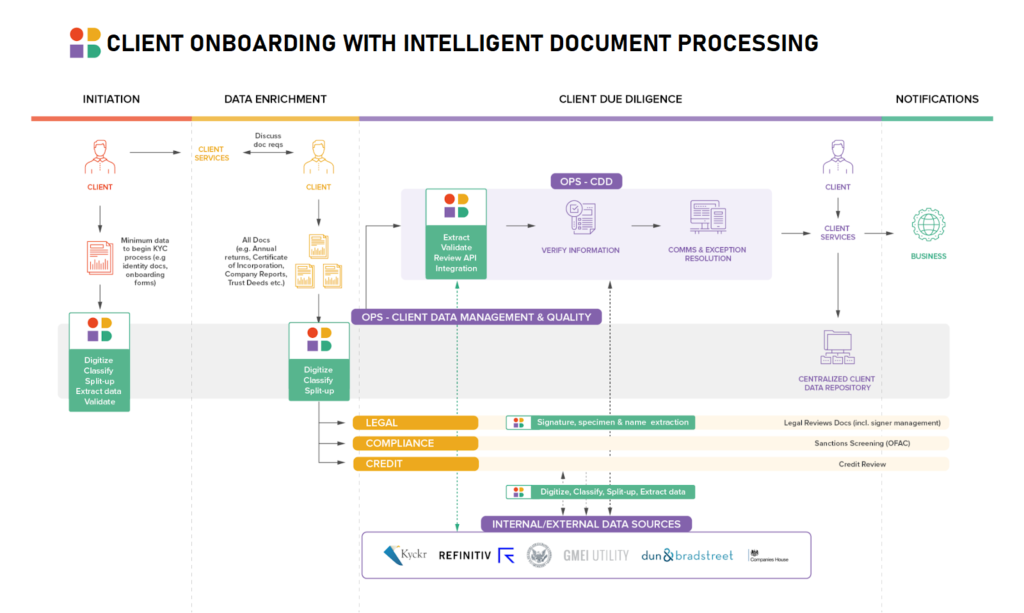

When onboarding new clients, investor services firms collect compliance documents for individuals and institutions. Individual directors and executives provide proof of identity, proof of address, passports, and other required documents. Funds also submit constitutive and governing documents such as certificates of registration/incorporation, memoranda and articles of association, address proofs, board resolutions, licenses, tax forms, IMAs etc.

The challenge is that most of these documents fall into the category of unstructured data that cannot be easily processed by traditional technologies. Although the data contained in the documents can provide valuable customer and risk insights for providers, organizing and accessing that data is problematic – typically occupying highly trained resources in mundane data extraction and entry. These manual processes result in higher costs, lengthy processing times, and worse customer experiences.

The Automation Platform for Unstructured Data from Instabase, however, leverages cutting edge deep learning technology to automatically extract unstructured data, converting it into structured data in custom schema for downstream systems. This allows providers to easily understand and act on insights previously accessible only through tedious manual processes.

Investment Documents

Perhaps the largest scope for deriving value from data exists in the area of investment documentation. Capital call documents, for instance, are highly variable two-to-three page documents, and service providers process large volumes of them. Initial subscriptions can be lengthy, descriptive legal agreements with over 100 pages. The same scenario applies to redemption documents.

It is extremely difficult for traditional technologies to extract key data fields and natural language information from large documents like these with such variable content. However, Instabase’s Automation Platform for Unstructured Data achieves a high level of accuracy pulling unstructured data found in highly variable, complex documents. Thus, providers benefit from significant time savings and attain much more insightful, usable data.

Reporting Requirements

Regulatory reporting requirements for the finance sector have grown tremendously in recent years, and they change often. Compliance with regulation, both financial and trade reporting, as well as regulatory reporting, are critical for providers. Failure to comply could expose the provider to strict financial penalties, reputational damage, amongst other punitive consequences. Accessing and processing all required data to ensure appropriate compliance with reporting requirements is a complex and onerous process.

Portfolio reporting is also a service administrators provide to their customers. Fund administrators hold and store thousands and thousands of documents that contain this data, such as fund memoranda, transaction instructions, valuations, brokerage statements, fund holding reports and so on, often in nested structures and with interconnections. It is not uncommon for each fund held by a client to have 100 or more underlying assets. Traditional extraction methods simply don’t allow for accurate data extraction while trying to correlate each fund to its underlying assets for all client reports. Harnessing the power of deep learning, Instabase’s Automation Platform allows for this, opening the door to cost efficiency and scale benefits for providers.

(Learn more about The Automation Platform for Unstructured Data from Instabase when you download “The Ultimate Deep Learning Guide for Unstructured Data.”)

Power Your Processes with Instabase

Each of the three functions discussed here involve the large-scale collection of unstructured data found in highly variable, complex documents. As investor services organizations scale, manual processes for handling unstructured data are simply not feasible from a financial or operational standpoint.

Providers that utilize the intelligent document processing capabilities of Instabase achieve critical advantages in cost efficiency, margins, and profits. They also enhance safety and security for their clients, while more effectively meeting constantly changing regulatory requirements. The industry is moving in this direction for handling unstructured data; don’t get left behind. Power investor services processes with the Instabase Automation Platform for Unstructured Data.

Streamline investor services.

Automatically understand unstructured data with the Instabase Automation Platform.