Intelligent Automation in Banking and Financial Services

The financial services industry is one of the largest processors of data globally. Much of this data comes to organizations in the form of documents, many of which are lengthy and complex.

For example, financial services organizations routinely receive documents such as:

| Proof of identity documents | Tax returns | Legal contracts |

| Proof of address documentation | Bank statements | Loan documents |

| Investment portfolio statements | Board resolutions | Disclosure statements |

| Lease or rental agreements | Corporate documents | Credit reports |

| Investment instructions | Prospectuses |

These document types vary widely. For instance, consider the difference between a driver’s license that helps to verify identity and a corporate tax return that involves multiple schedules and forms. Or consider the difference between a bank statement and an investment prospectus.

The different forms such documents take mean that much of the data financial services organizations ingest and consume come in the form of unstructured data that does not adhere to any particular format.

To understand unstructured data requires one of two things: (1) manual review by a human, which is both time-consuming and costly or, (2) intelligent automation of document understanding.

Intelligent automation refers to the use of artificial intelligence and machine learning to perform tasks automatically, without the need for human intervention. Is it really possible to leverage intelligent automation in financial services? The answer is a resounding “yes.”

Financial Services Automation Focus Shifts

Many financial services processes have already been automated, especially for client-facing activities. Automation efforts have historically focused on workflow management and automating specific processes.

However, with the rise in computing power and rapidly advancing AI technologies, forward-thinking financial services organizations have shifted their focus from simply automating processes to automating data.

Such organizations are closing the gaps between data ingestion and optimized data consumption. They have evolved from merely using automation for tasks such as pricing, execution, and risk management to automating tasks at the document ingestion level.

Business Value of Intelligent Automation for Financial Services

Automating data from the point of ingestion is the next logical step in the financial services digital transformation journey.

Intelligent automation provides financial services organizations with improved data access by formatting and making data accessible to downstream systems for consumption. Where once the task of manual review of all documents fell firmly on the shoulder of employees, intelligent automation allows organization to process many types of documents without the need for human intervention.

The business value of that is clear. It frees employees to work on higher-value tasks rather than focusing on document review and data entry to make information available to downstream systems. It saves time and money and helps to grease the wheel for data analytics that yield actionable insights. Those insights help financial services organizations derive every drop of value from the data they have.

In short, intelligent automation supercharges both workflows and data consumption, leading to faster insights, faster response to evolving business needs, and better business outcomes.

Why Choose Instabase for Intelligent Automation

Instabase works with some of the largest financial services organizations today to automate data and drive better business outcomes.

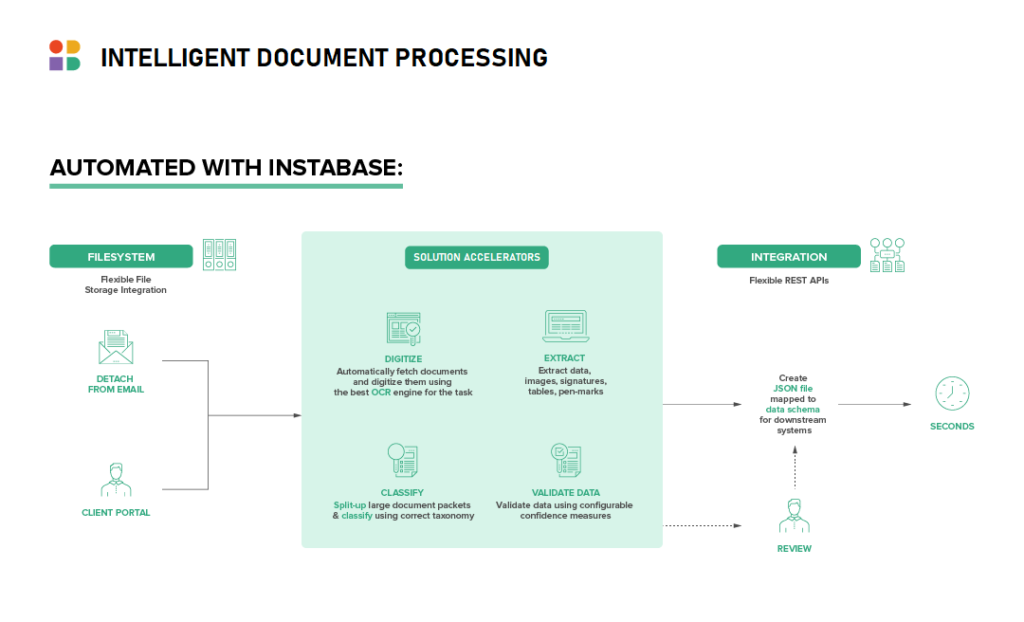

The Instabase Platform provides a revolutionary approach to document automation. Instabase leverages deep learning technology and natural language processing, combined with low-code building blocks to help financial services organization ingest, classify, split, enrich, validate, and push out relevant data to downstream systems in a structured format.

Because of its unique building block approach, Instabase can be easily embedded into existing processes, working seamlessly with existing systems and technologies already in place in your organization.

With Instabase, financial services organizations can:

- Eliminate or greatly reduce most of the costly, tedious manual review of unstructured documents.

- Extract relevant data from unstructured documents with a high degree of accuracy.

- Speed the delivery of excellent customer experiences by eliminating process bottlenecks.

- Scale quickly, adding capacity for more business without adding associated employee costs.

Learn more about intelligent automation for financial services in The Big Book of FSI Use Cases and our financial services solution page.