Intelligent Document Processing in Banking and Financial Services

Documents are everywhere in financial services. For organizations looking to streamline operational processes and move further along on their journey to financial services digital transformation, intelligent document processing is a foundational element for moving forward.

What Is Intelligent Document Processing?

Traditional document processing involves the manual review and disposition of documents, whereas intelligent document processing uses a form of machine learning known as deep learning and natural language processing (NLP) to understand and process the data found in unstructured documents. It greatly reduces or even eliminates manual review of documents by automating document understanding.

Why Financial Services Needs Intelligent Document Processing

Most financial services organizations are inundated with a heavy volume of documents for processing.

These documents come from a variety of sources, such as emails, faxes, postal mail, vendor portals, and more. They also arrive in a variety of formats, from structured documents to highly variable documents with little or no structure.

The highly variable nature of documents in financial services has historically necessitated manual document review, a process that is time- and labor-intensive. Without manual review, organizations have not been able to access the data they need from documents, extract it, and send it forward to downstream systems for use. This has, in turn, has led to a lack of visibility into business data that has hampered decision-making and negatively impacted customer experience.

Some financial services organizations have entire teams dedicated to the manual review of documents, and these teams continue to grow as the business grows and processing needs increase over time. This is not a sustainable model for scalability.

Intelligent document processing eliminates much of the manual review processes that create bottlenecks, helping organizations streamline operations and deliver better customer experiences.

Why Many Document Processing Technologies Fall Short

In an effort to automate document processing, financial services organizations have adopted a variety of solutions. Many of these solutions are specific to a particular use case, meaning that they cannot scale over multiple processes. That is a significant problem because the type and format of documents continues to be highly variable. Organizations can find themselves adopting multiple point solutions, which adds even more complexity to workflows.

Another shortcoming of many document processing solutions is that they are simply not sophisticated enough to provide the level of accuracy required for financial services. A lack of accuracy in document processing raises substantial risks for financial institutions. To mitigate that risk, any document processing solution used should be highly accurate and reliable.

Point solutions also tend to perform simple automation tasks, leaving the “heavy lifting” of document processing to human reviewers. They prevent financial services organizations from completing their digital transformation journey, lacking the “last mile” element that intelligent document processing powered by deep learning technology can provide.

What Is Deep Learning and Why Is It a Game Changer for Financial Services?

Deep learning is an advanced subset of machine learning inspired by the human brain and built from a large, deep neural network. It fundamentally changes the way financial services organizations approach their document-based processes.

Document processing solutions that leverage deep learning are superior to previous technologies used to understand unstructured documents. That is because deep learning models are trained on a huge amount of data, and they autonomously learn and solve highly complex problems the way a human brain might, but at much higher speed.

Document processing solutions that use technologies such as deep learning and natural language processing can interpret highly variable documents such as contracts, financial statements, credit reports, correspondence, and even handwritten documents with a high degree of accuracy that previous types of document processing solutions simply could not tackle.

To learn more about how deep learning has fundamentally changed document processing and understanding, download your free copy of “The Ultimate Deep Learning Guide for Unstructured Data.”

Deep Learning Opens Up New Areas for Financial Services Automation

Intelligent document processing solutions leveraging deep learning pave the way for financial services organizations to explore new areas for automation. Here are just a few examples of complex document processes that can now be automated with intelligent document processing:

Structured Finance

Structured finance has gained popularity in recent decades because it addresses the complex financing needs of organizations for which conventional financial products are not a good fit. Used to manage risks and develop financial markets for complex emerging markets, structured finance is, of necessity, heavily document-intensive.

Some of the more common structured finance instruments include collateralized debt obligations (CDOs), collateralized mortgage obligations (CMOs), collateralized bond obligations (CBOs), synthetic loan instruments, and syndicated loans.

Using intelligent document processing enables financial services providers to quickly ingest, split up and classify, validate, enrich, and send relevant data from a mountain of documents to the appropriate downstream systems for use. This relieves much of the burden of manual review for structured finance transactions.

Complex Loan Agreements

Similarly, intelligent document processing speeds up complex loan workflows. A complex loan agreement may be several hundred pages long and may include addendums and multiple schedules and added clauses.

Handling these lengthy, complex documents with intelligent document processing that leverages deep learning eliminates the bottlenecks that inherently accompany manual document review. By accelerating the process, intelligent document automation enables lenders to quick parse the important information contained in complex, lengthy loan agreements, use that information in downstream systems, and deliver efficient customer experiences at scale.

Lengthy Legal Contracts

Corporate lending is especially likely to involve the review and use of lengthy contracts. Intelligent document processing enables lenders to quickly ingest, classify, validate, and extract relevant data from legal contracts that may contain hundreds or even thousands of pages. What once to hours of painstaking, meticulous human review takes seconds with intelligent document processing solutions.

ECM/DCM Prospectuses

On the investment side of financial services, intelligent document processing can streamline document understanding for debt capital market (DCM) and equity capital market (ECM) prospectuses. There is much regulation regarding the content of such documents, and prospectuses are often very lengthy and highly complex. Because these documents contain large volumes of unstructured data, they are ideal candidates for intelligent document processing with deep learning.

These are just a few examples of the types of documents and use cases that call for intelligent document processing.

How Instabase Can Help

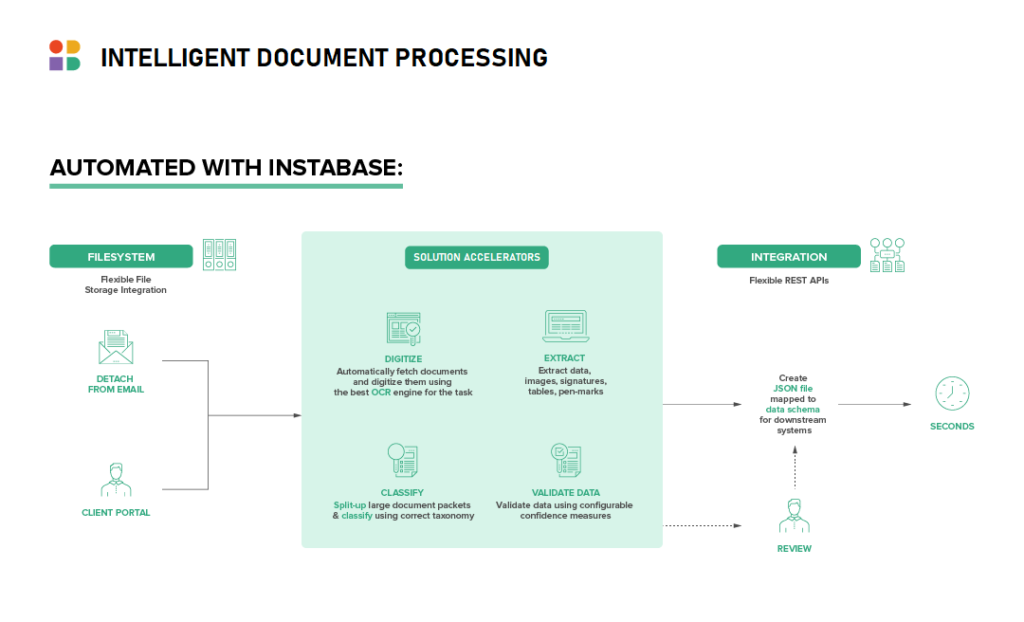

The Instabase Platform leverages deep learning technology, natural language processing, and a low-code building block approach to ingest, split up and classify, extract, validate, and enrich data from both structured and unstructured documents with a high degree of accuracy.

With Instabase, financial services organizations can:

- Eliminate or greatly reduce most of the costly, tedious manual review of unstructured documents.

- Extract relevant data from unstructured documents with a high degree of accuracy.

- Speed the delivery of excellent customer experiences by eliminating process bottlenecks.

- Scale quickly, adding capacity for more business without adding associated employee costs.

Learn more about intelligent document processing for financial services in The Big Book of FSI Use Cases and our financial services solution page.