Buoyed by post-COVID-19 recovery activities, international trade finance is forecast to grow in the next few years at a robust pace.

Lacking funds needed to finance large global trade transactions, most exporters require financial backing. This fact, coupled with today’s severe shipping bottlenecks, materials shortages, and the world’s increasing appetite for goods, means the trade finance market “is expected to reach USD 10426.67 Billion by the end of 2026, growing at a CAGR of 5.37% during the forecast period 2020-2026,” according to a news release from market-research-report provider Valuates Reports.

A primary reason for this growth? “Rapid urbanization and … steadily growing global trade,” the report “Trade Finance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2021-2026” reads. “Furthermore, the integration of advanced technologies, such as blockchain, artificial intelligence (AI), machine learning (ML) and the Internet of Things (IoT) with trade finance, is also providing a boost to the market growth.”

Those financiers that make use of such technological advancements greatly increase their chances of success in the market. Using ML and AI tools, the Instabase Automation Platform for Unstructured Data significantly reduces the burdens on banks and other trade financiers.Here are just some of the top ways it does so.

More Underwriting

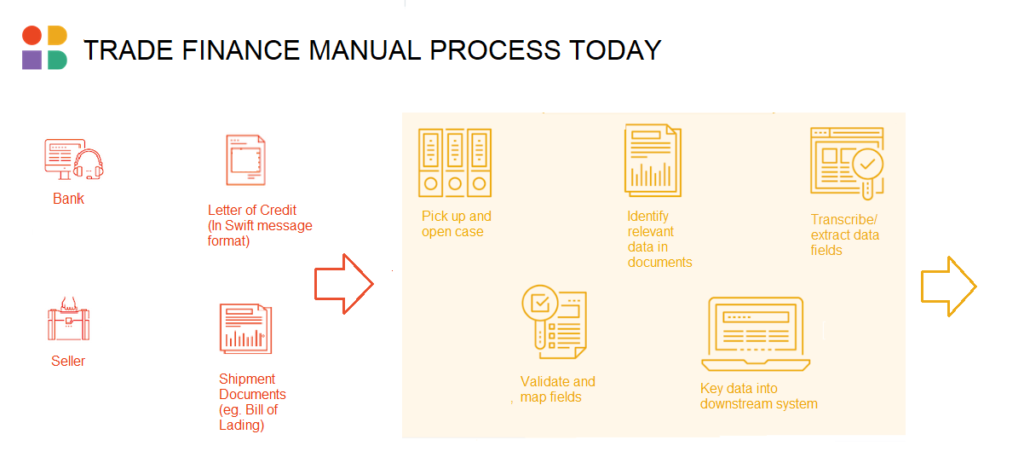

Toby Burton, business value consultant with Instabase, highlighted some of the challenges facing trade finance processes today, stating: “To understand documents, extract the right data, and feed it to a rules engine is a time-consuming process. And then there’s the risk of human error to consider.”

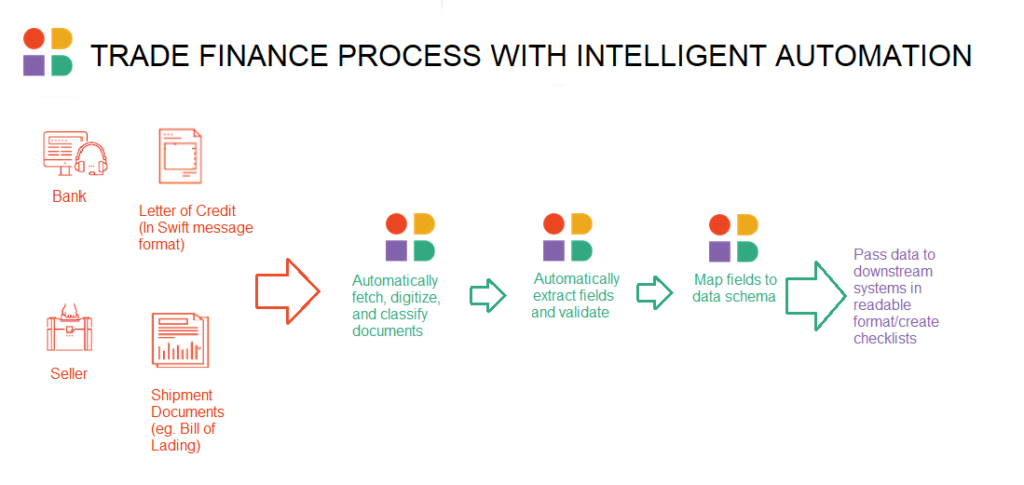

Instead, automating much of the review process with Instabase results in better, faster understanding and extraction of the material in complex trade documents. For example, Instabase can quickly identify the contents of SWIFT MT700 messages, documents used by financial institutions to issue letters of credit. Using Instabase, a financial institution can process a SWIFT MT700 in just 10 seconds.

With huge reductions in cost and time to review and classify incoming documentation, banks involved in trade finance can scale their underwriting operations without growing their operations costs.

Better Servicing

In part because it can detect which documents clients have submitted and then ensure that all required documentation is in the system for processing, the Instabase Automation Platform also allows financial institutions to deliver better customer service. Automatic extraction of key data from submitted documents, including bills of lading and exchange and commercial invoices, leads to better, clearer communication between financial institutions and borrowers. Increased transparency and less back-and-forth make for a vastly improved customer experience.

Faster Delivery

The sooner a trade finance customer receives service delivery, the better. Instabase provides the needed speed. With quicker, better document classification, indexing, and information extraction, as well as the automatic population of myriad required digital fields, Instabase solutions are able to confirm documents and understand information without waiting for manual review. That capability reduces the number of document hand-offs on the lender side and cuts wait times for the customer.

Further, Instabase flags those documents that cannot be processed with deep learning technologies so that human reviewers know exactly what is in need of review and how to prioritize it, which also leads to a better lender and customer experience.

Need help with trade finance processes? Get workflows without the wait with the Instabase Automation Platform for Unstructured Data.

Workflows without the wait.

The instabase Automation Platform lets you create powerful workflows fast.