Documents to establish creditworthiness of small businesses have a high degree of variability and often slow down lending decisions, leading to poor customer experiences.

Instabase for Small Business Lending

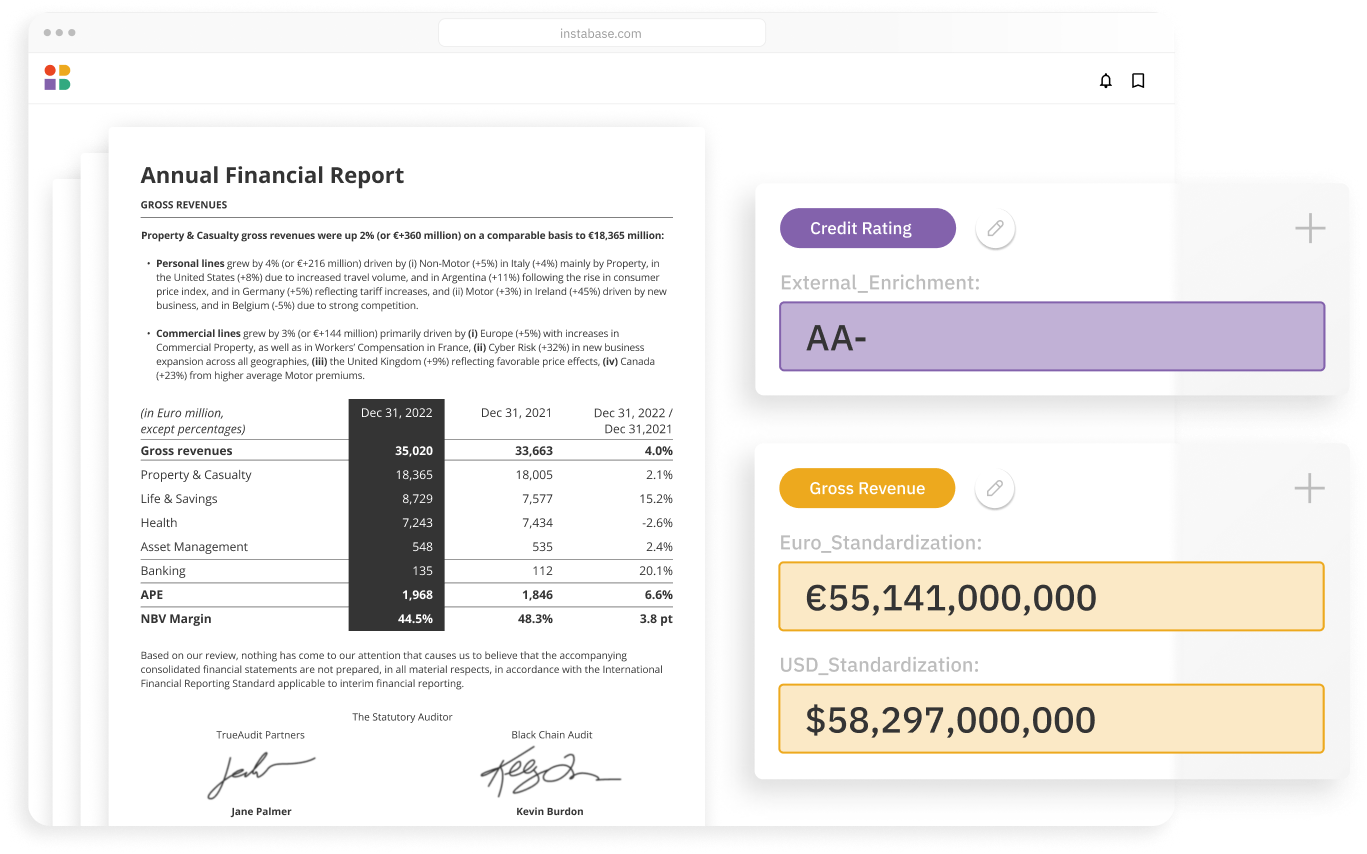

Instabase automates document understanding for all relevant documents in small business lending, such as bank statements, tax returns, articles of incorporation, registration certificates, passports, invoices, and more, to streamline small business lending in an end-to-end workflow.

Processing Small Business Loans

Why Instabase?

The Instabase Platform extracts information from all relevant documents to speed up lending decisions, helping banks efficiently scale up accounts, provide an excellent customer experience, and become a trusted partner for small businesses.

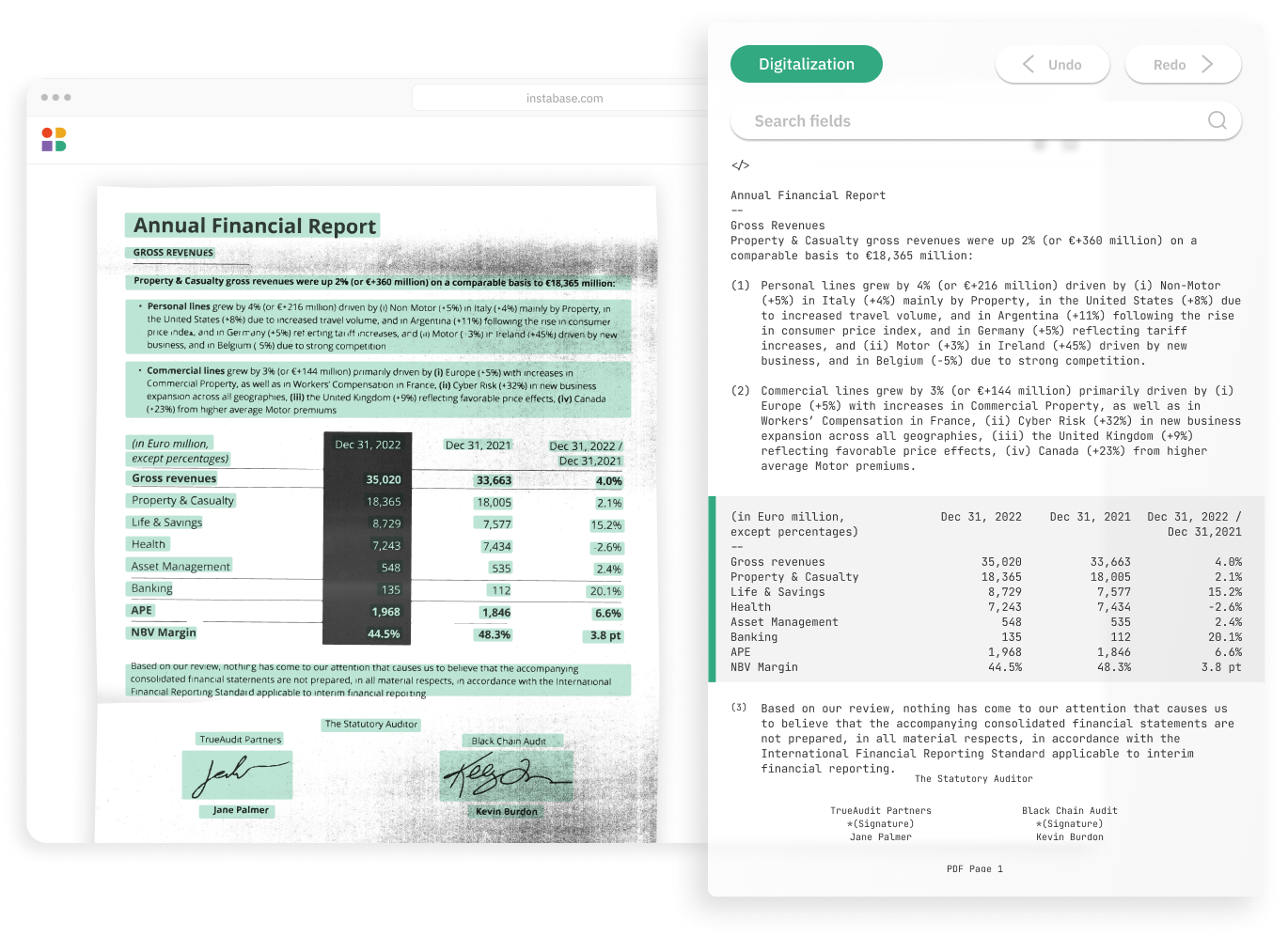

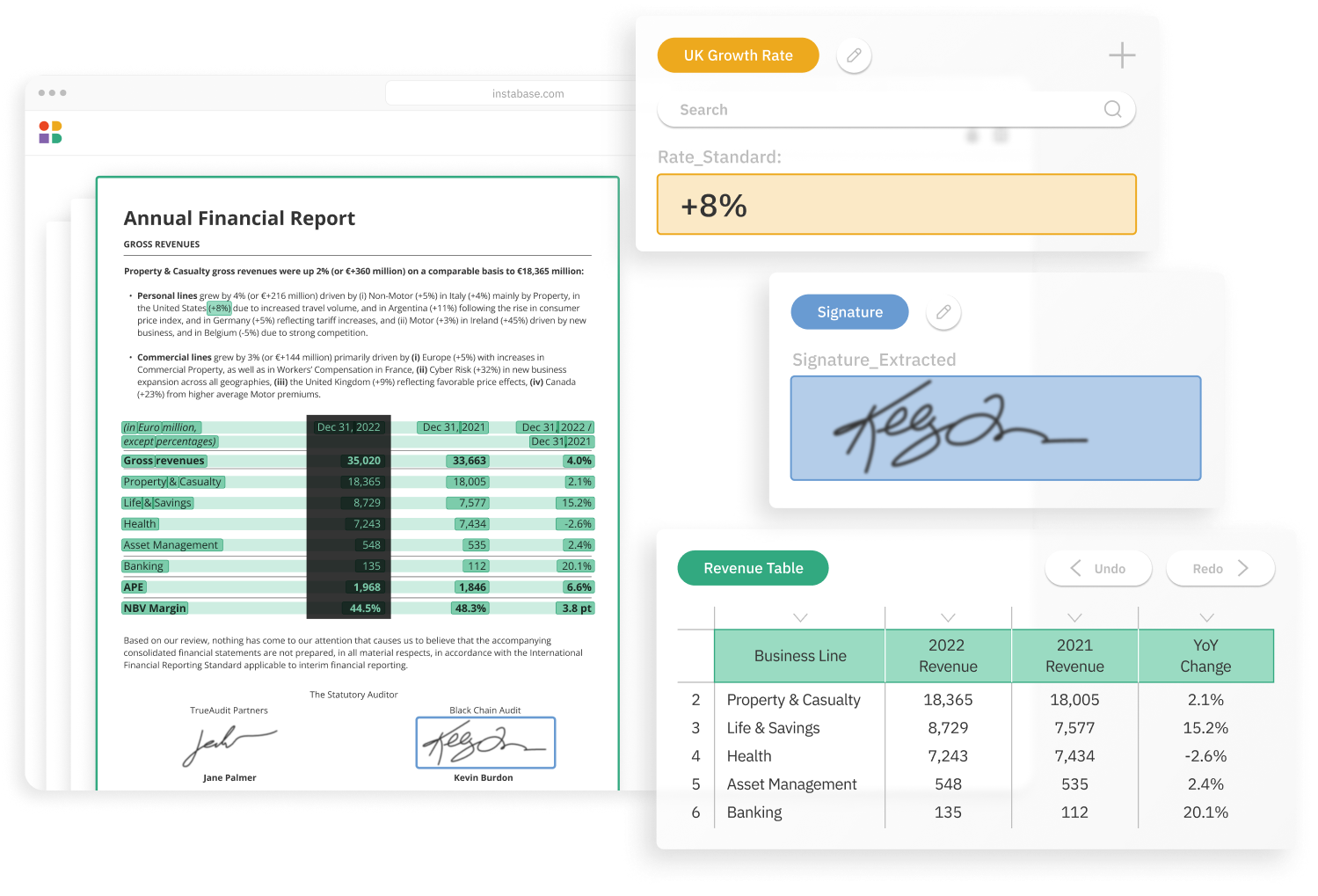

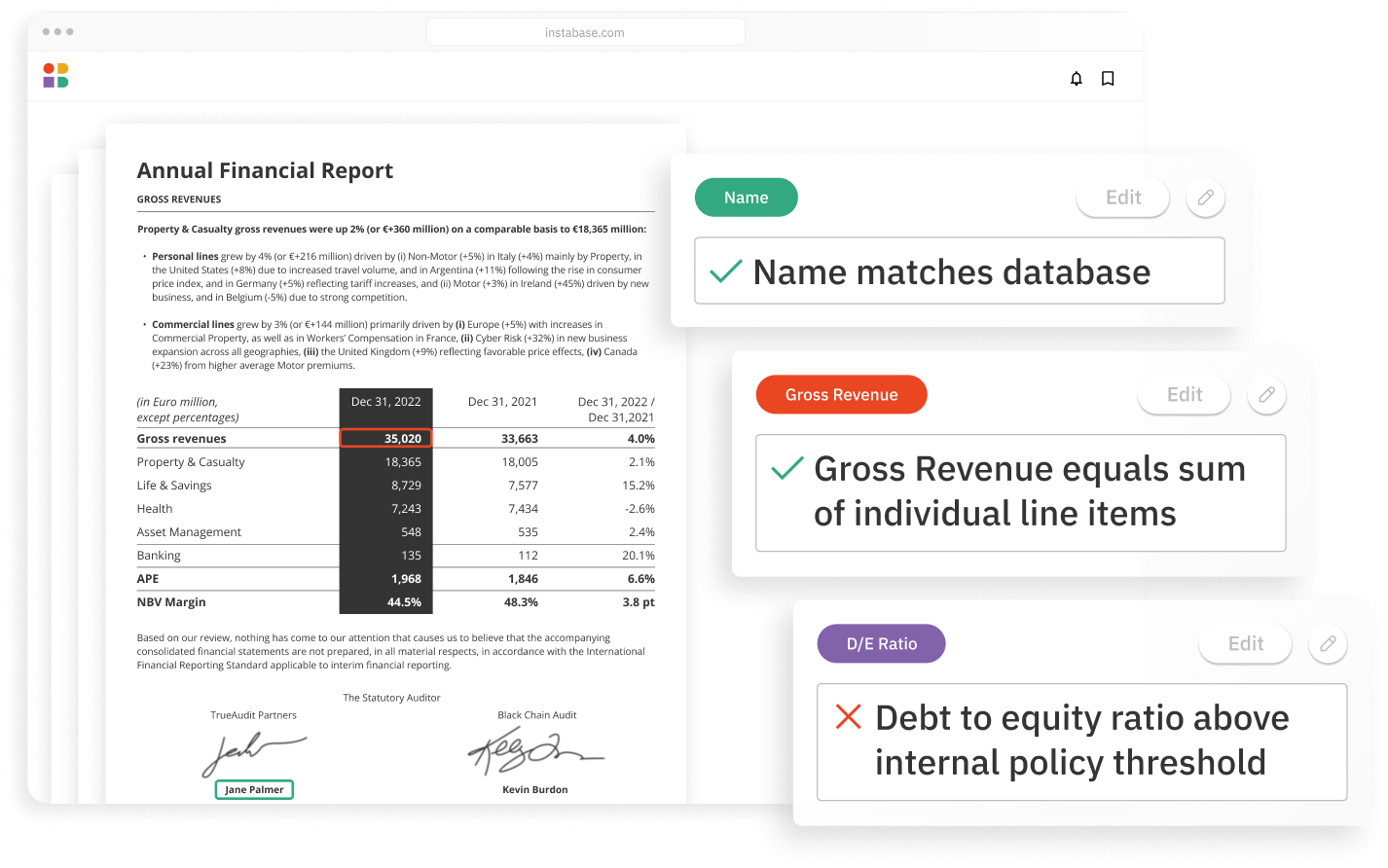

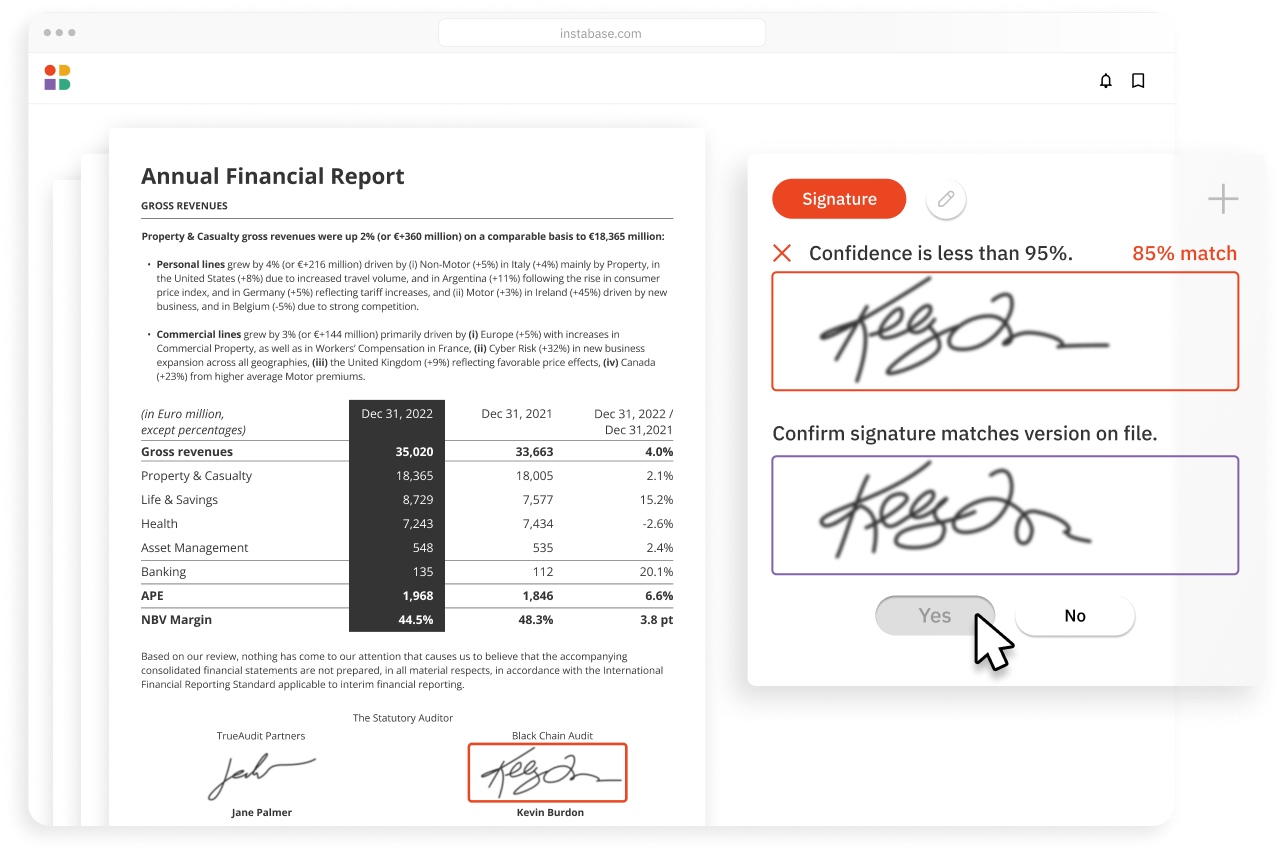

Accurately automate any document type

- Highly accurate extraction

- Any structure, any language

- Handwriting & printed

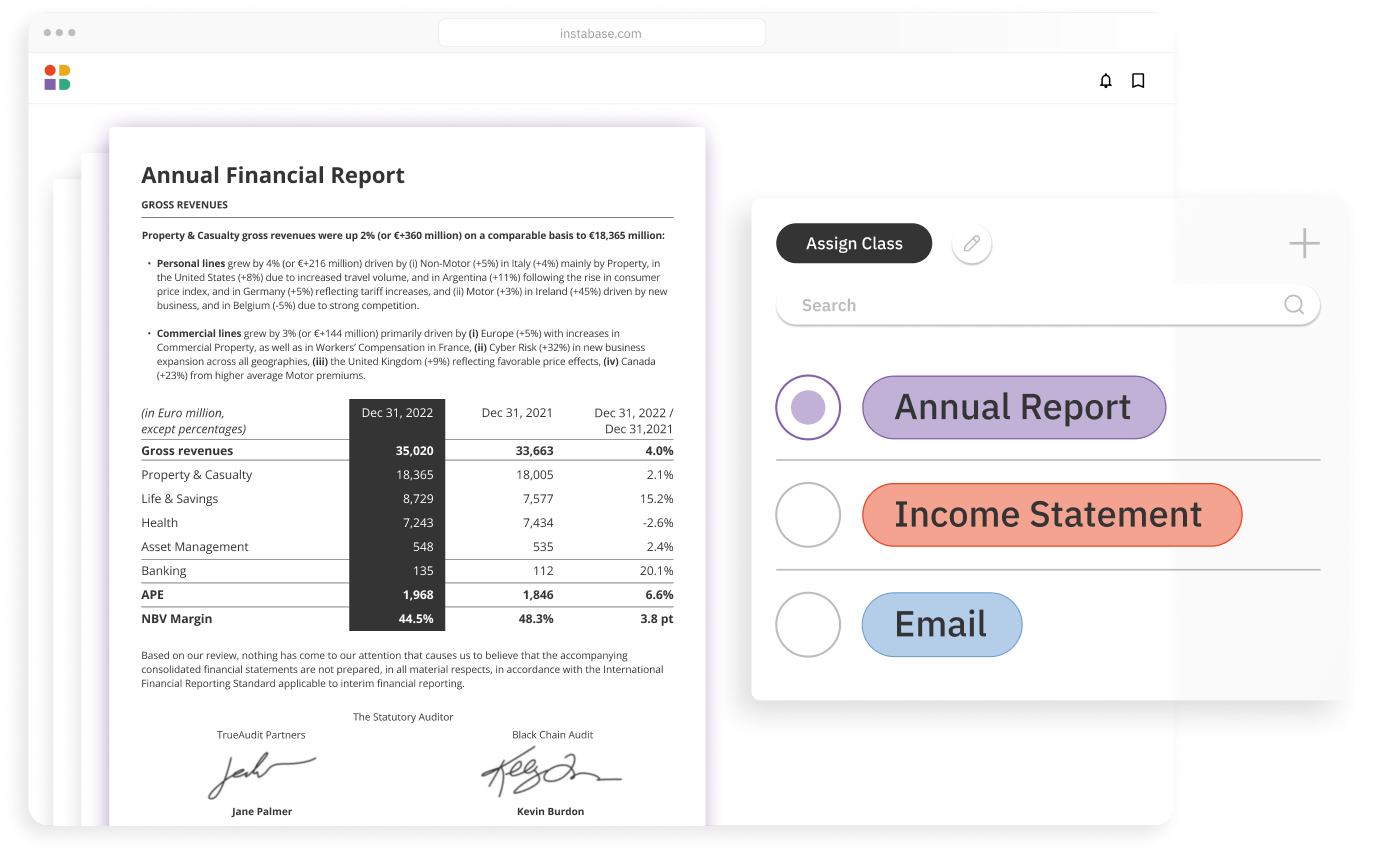

Use without any model training

- Out-of-the-box engine

- No model training required

- Configure fields & run

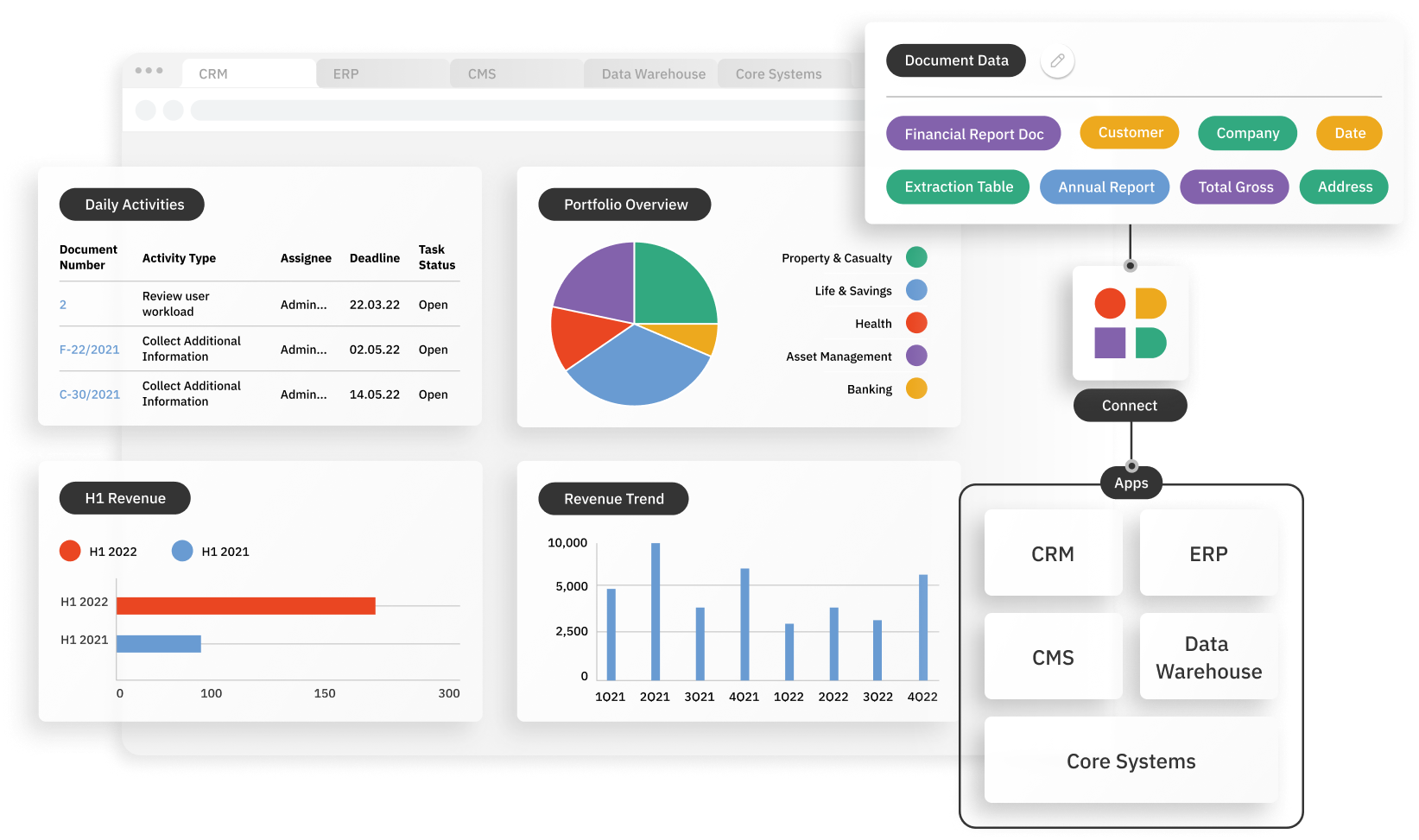

Easily embed into any workflow

- Scalable APIs

- Customize data schema

- Secure environment

How it works

Instabase combines the most powerful technologies for every step of the process, so you can automatically understand any document in the submissions process.