The corporate and investment banking (CIB) space has undergone significant transformation over the last few years. However, there is still much work to do to optimize efficiency and control costs.

Automation is critical to CIB organizations that want to do more with less. Profitability and risk management both hinge on having access to and processing the deluge of complex data CIB organizations need to ingest continuously. The ability to efficiently extract key data from unstructured documents through automation frees up qualified professionals to focus on decision making and customer interface.

Why Are Corporate and Investment Banks Focusing on Transformation?

Corporate and Investment Banks are heavily impacted by movements in financial markets and changes in regulation, and there have been plenty of both recently. Corporate banks deal with institutions and other large organizations with complex requirements. These complexities, coupled with large deal sizes, often across geographies and jurisdictions, lead to significantly high operational risks.

A central challenge for many CIB companies is that they have many business lines that engage in different types of activities. Thus, it is hard to find one solution to address inefficiencies across all units.

The following are additional reasons that CIB transformation is so important:

- Inefficient manual processes dominate common workflows.

- CIB still has a long way to go to maximize data access and usage for optimized decision-making.

- The sheer volume of unstructured data acquired presents challenges that technology has, until now, not been able to solve.

Drivers of Corporate and Investment Banking Transformation

Several factors have come together in recent months that are driving the transformation currently in progress in corporate and investment banking:

Pandemic

Demand from end customers for sophisticated technology systems escalated as a result of the pandemic. Customers expect convenient, tech-oriented processes for market access and trading, payments, lending and borrowing, and performing other common financial actions.

Financial Market Volatility

The volatility in financial markets over the last few years is unprecedented. Interest rates have remained extremely low for more than a decade, but high inflation has resulted in significant rate hikes around the world. As global banks initiate tightening cycles, market volatility is likely to remain high.

Reporting Requirements

Following the financial crisis, there has been increased emphasis on data integrity and customer protection in the financial sector. CIBs are dealing with a slew of new regulations in reporting requirements, data gathering, data processing, and risk management. Meeting these requirements in a cost-efficient way is difficult with manual processes.

The Role of Instabase in Corporate and Investment Banking Automation

CIBs have to be able to process vast amounts of complex data on a run-time basis and use it to manage risks and make appropriate financial decisions. The key is understanding how to extract data efficiently from a large volume of unstructured documents.

Leveraging the deep-learning capabilities of the Instabase Automation Platform, CIBs are finally able to access critical data points from its unstructured documents automatically. Instabase not only extracts the data, but organizes it in a way that can be seamlessly digested by downstream systems.

The following are three examples of specific use cases which demonstrate how CIBs are already automating extraction of unstructured data found in highly variable, complex documents:

Onboarding and KYC Processes

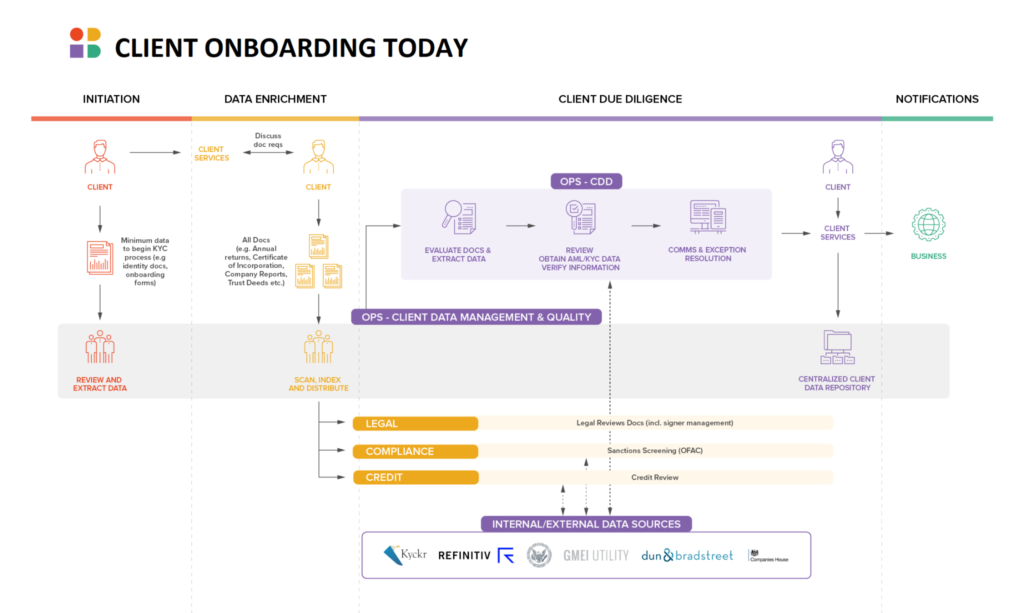

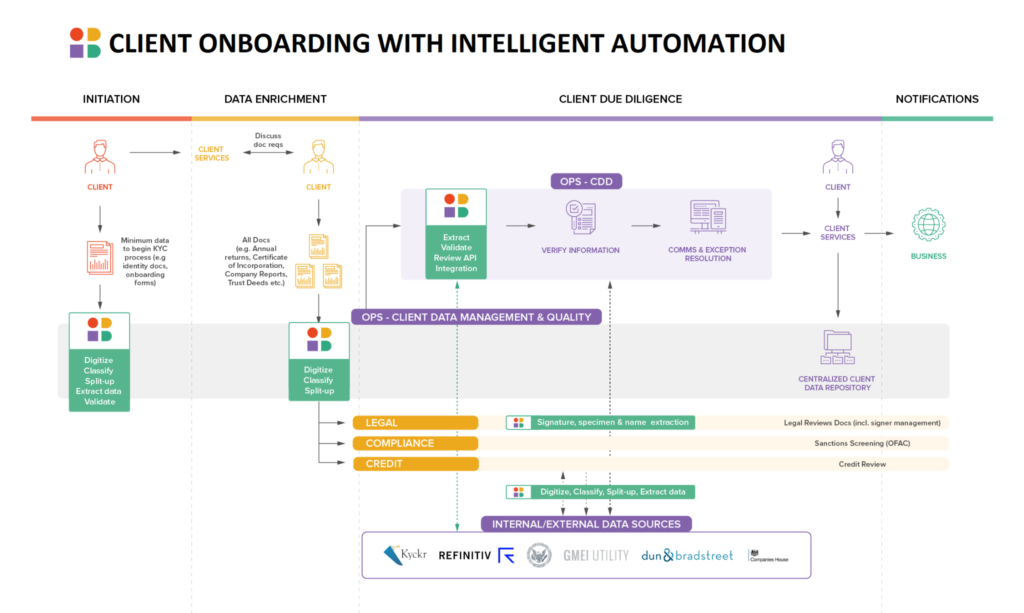

Stringent regulatory reporting requirements dictate that banks have easy access to customer information. This information is trapped in a variety of complex documents that differ by client type, geography, and the financial product or service the customer needs. In addition to these requirements at initial onboarding, any change in organizational structure of the client or event-driven risk must be monitored on an ongoing basis. Most banks employ many people to extract the necessary data for these processes, which is labor- and cost-intensive and creates risks of error.

Instabase works with many CIB clients to automate corporate and institutional onboarding and KYC processes. Doing so allows for more event-driven frequency as opposed to a need for more ongoing processing frequency.

Mailroom Automation

CIBs deal with a constant influx of client communications in the form of physical mail or email. Both the actual communication and the unstructured documents received through these channels are usually reviewed and processed manually.

The reviewers are typically highly qualified professionals, and the time spent reviewing documents to glean data is time away from their more critical job functions. Because of tedious manual review, urgent and actionable items may be overlooked for days.

With Instabase automation, CIBs classify emails by urgency and ownership of action. After triage, communications are automatically routed to the appropriate teams. Urgent or critical communications are reviewed and acted on first. As a result of automation, many work hours are saved, critical tasks are prioritized, and risks of actions being missed are minimized. Most importantly, customers receive faster responses and experience better interactions with their banks.

Structured Finance

CIBs underwrite highly complex loan facilities as part of their Structured Finance business. The terms and conditions of the loan, the collateral that secures the loans, as well as counterparties that take on the credit risk, can be of very different types. As a result, this business is underpinned by long, complex legal documents. Multi-page documents require extensive review, not just from banking teams but also from lawyers and paralegals. This approach means very qualified professionals are spending valuable time completing tasks that are not central to their primary value to the organization.

With Instabase’s deep-learning automation, critical data is extracted from various types of long, complex, unstructured financial documents, such as loan agreements, credit agreements, intercreditor agreements, collateral valuations, and many more.

By automating document processing, bankers and lawyers can dedicate more time to evaluating risks and facilitating loan approvals rather than manually reviewing documents. This scenario means the organization is getting the most value from its highly qualified professionals, thereby increasing the ability to service more clients in a more customer-friendly manner.

Automate with Instabase

The automation capabilities available from Instabase are critical to corporate and investment banking organizations that want to survive industry transformation. Automation reduces the burden on human resources and helps organizations optimize cost efficiency when managing risk, return, and compliance.

In addition to the examples provided, Instabase automation works with numerous other unstructured documents, including settlement instruments, SWIFT messages and faxes, trade and payment instruments, confirmations, and contracts, to name a few.

Simplify your complex data workflows with the Instabase Automation Platform for Unstructured Data. Learn how by requesting a demo.

Building blocks for your business data.

Simplify complex data workflows with the Instabase platform.