Payslips, bank statements, broker statements, tax returns and other income verification documents require manual review and slow down time-to-decision and time-to-cash in consumer lending.

Instabase for Consumer Lending

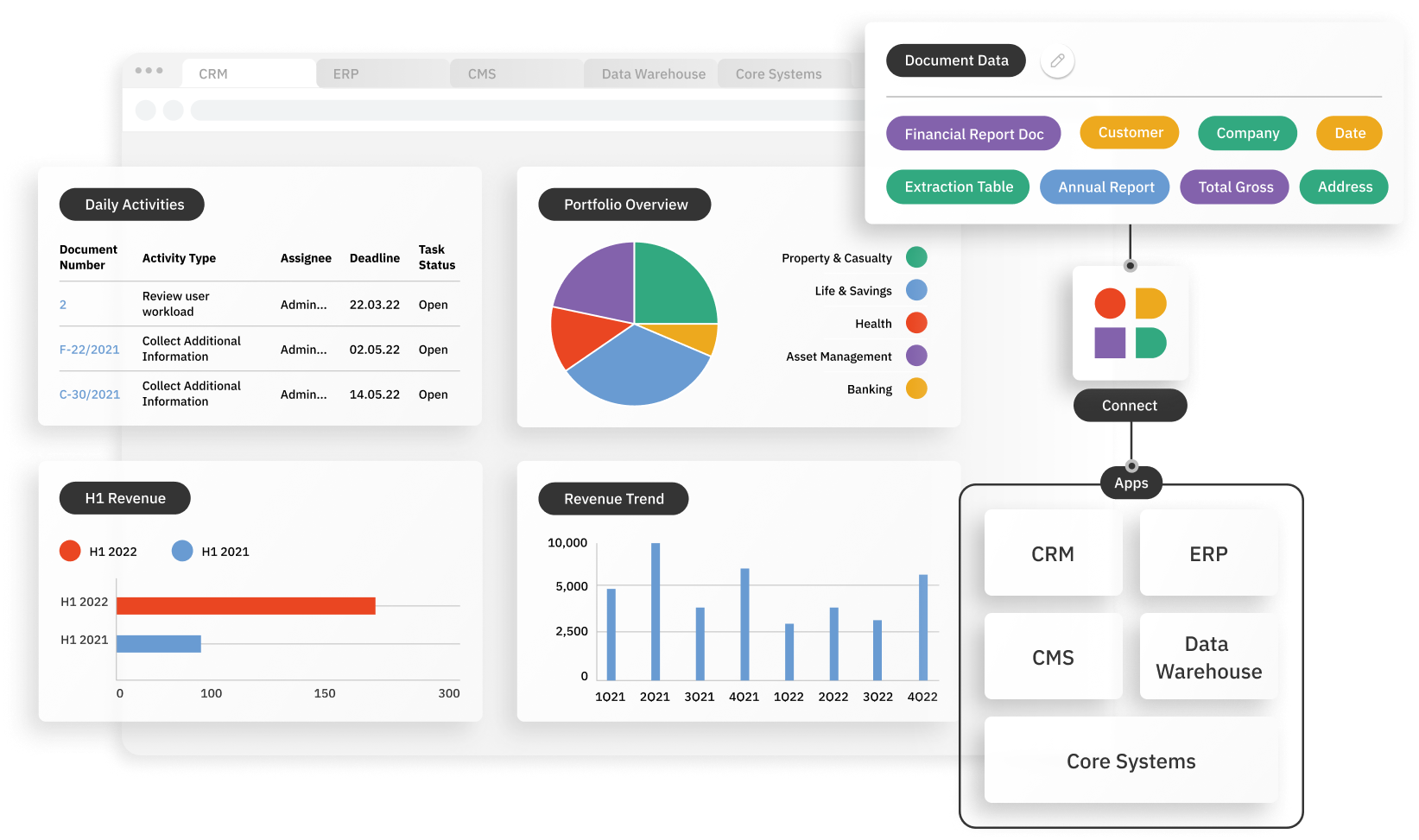

Instabase automates document understanding for complex documents needed for identity and income verification in consumer lending in an end-to-end workflow.

Processing Consumer Loans

Why Instabase?

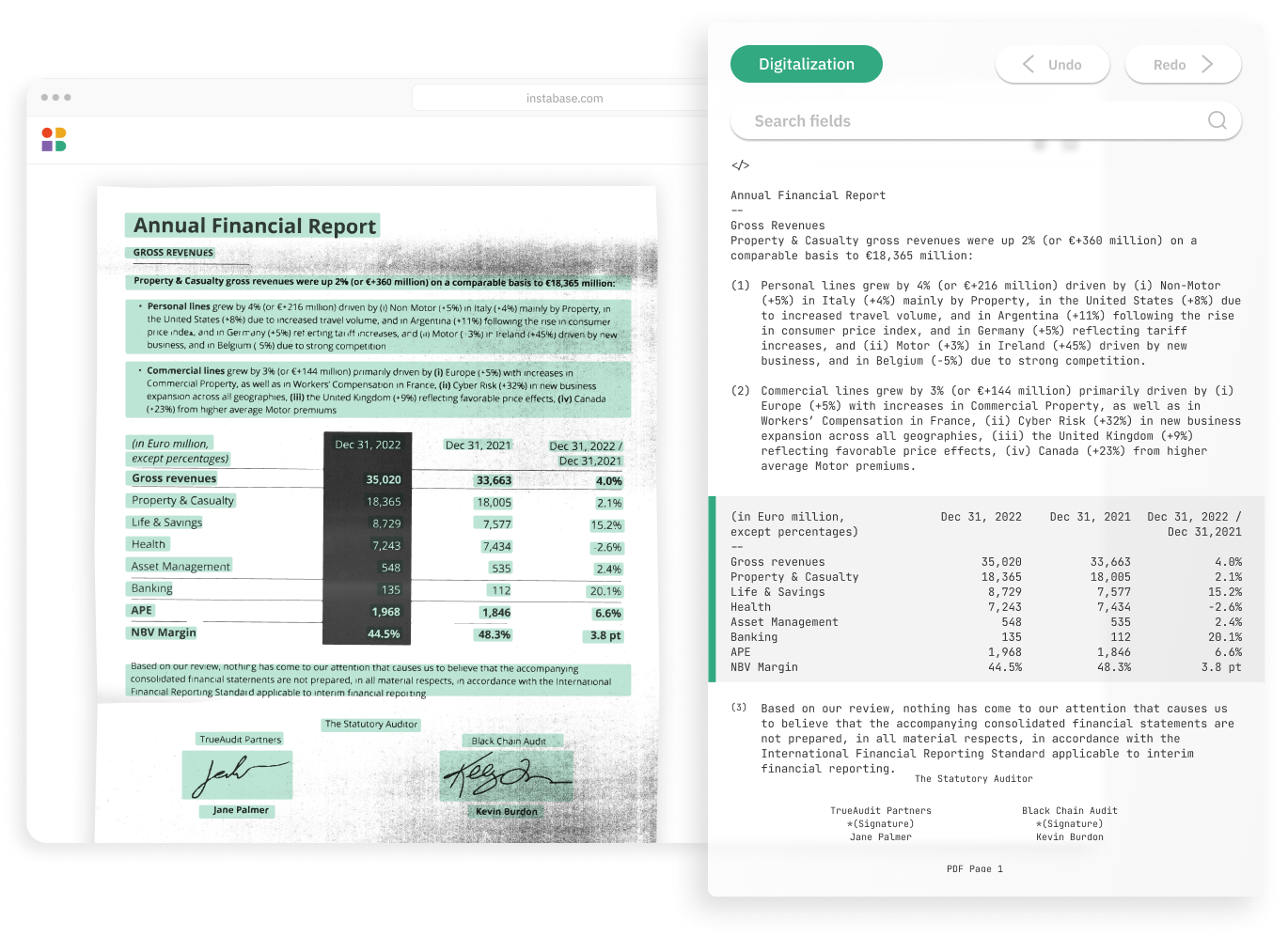

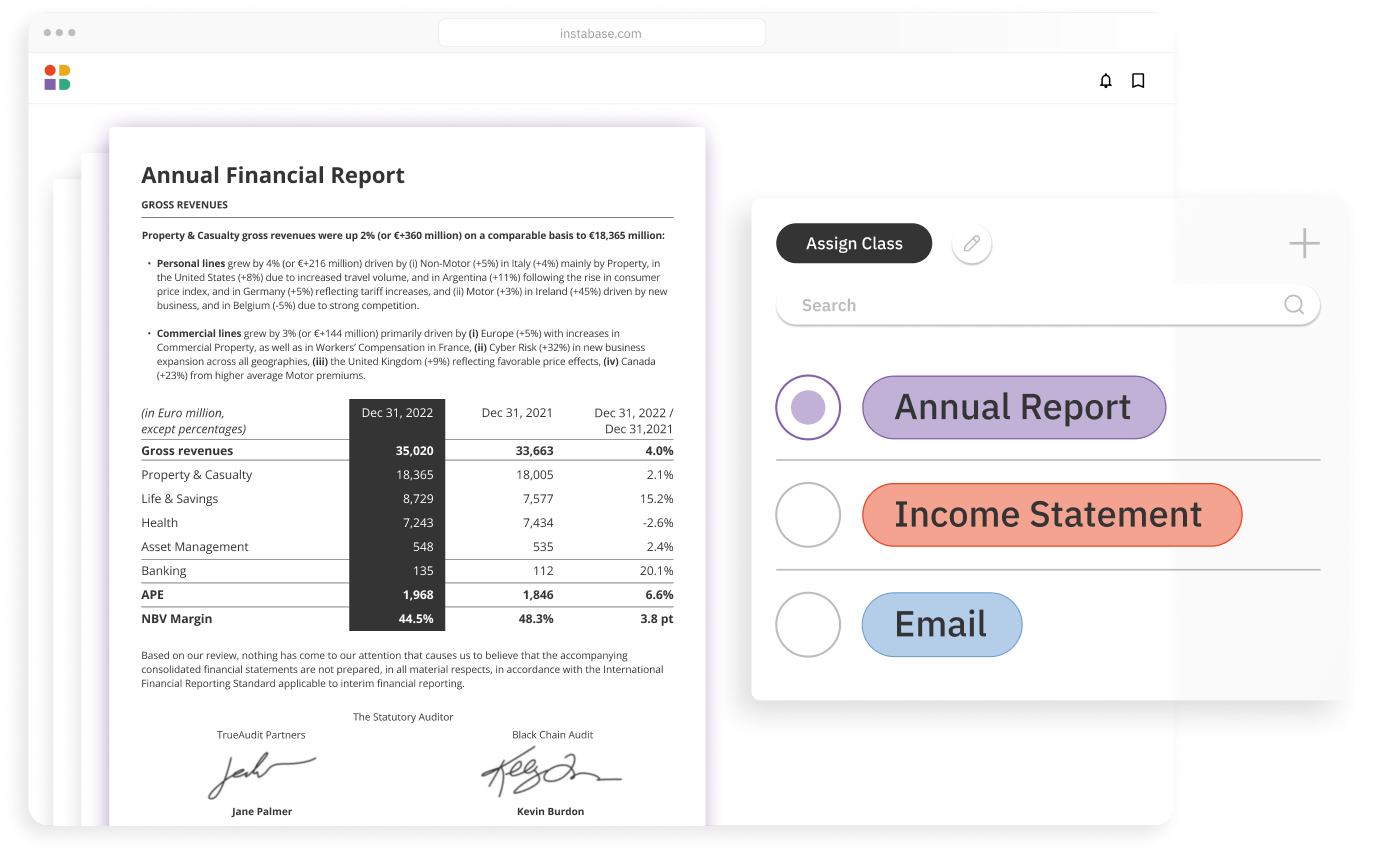

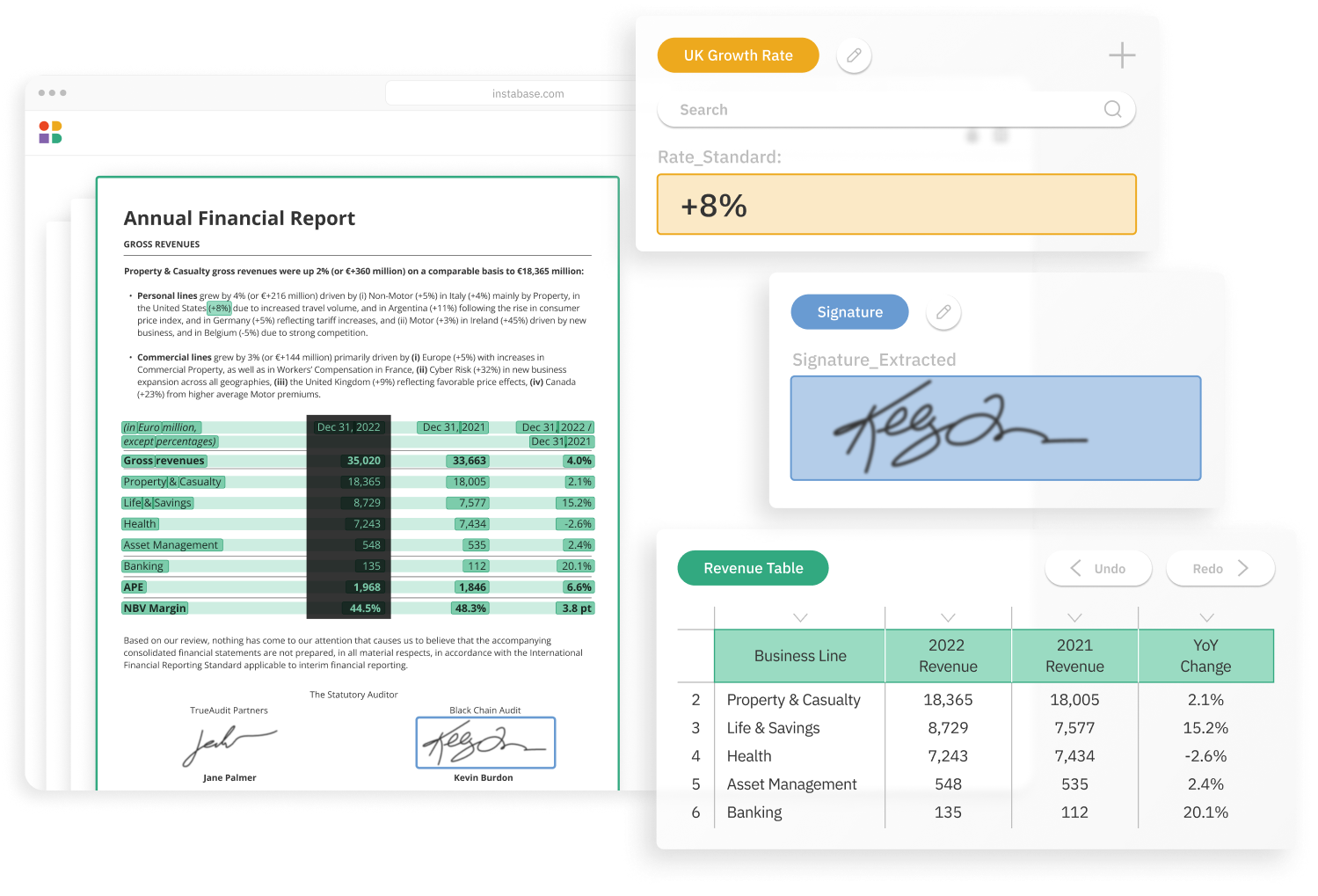

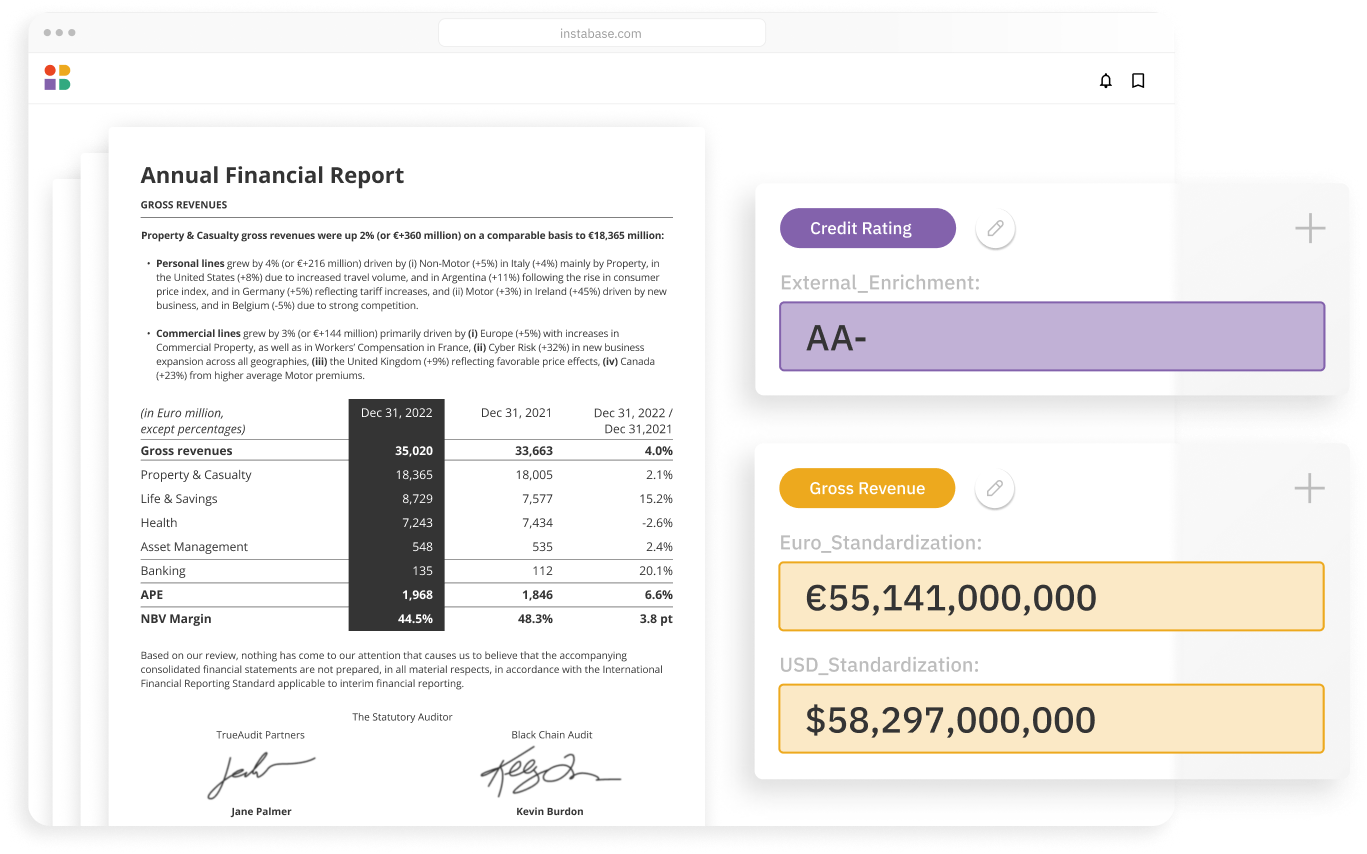

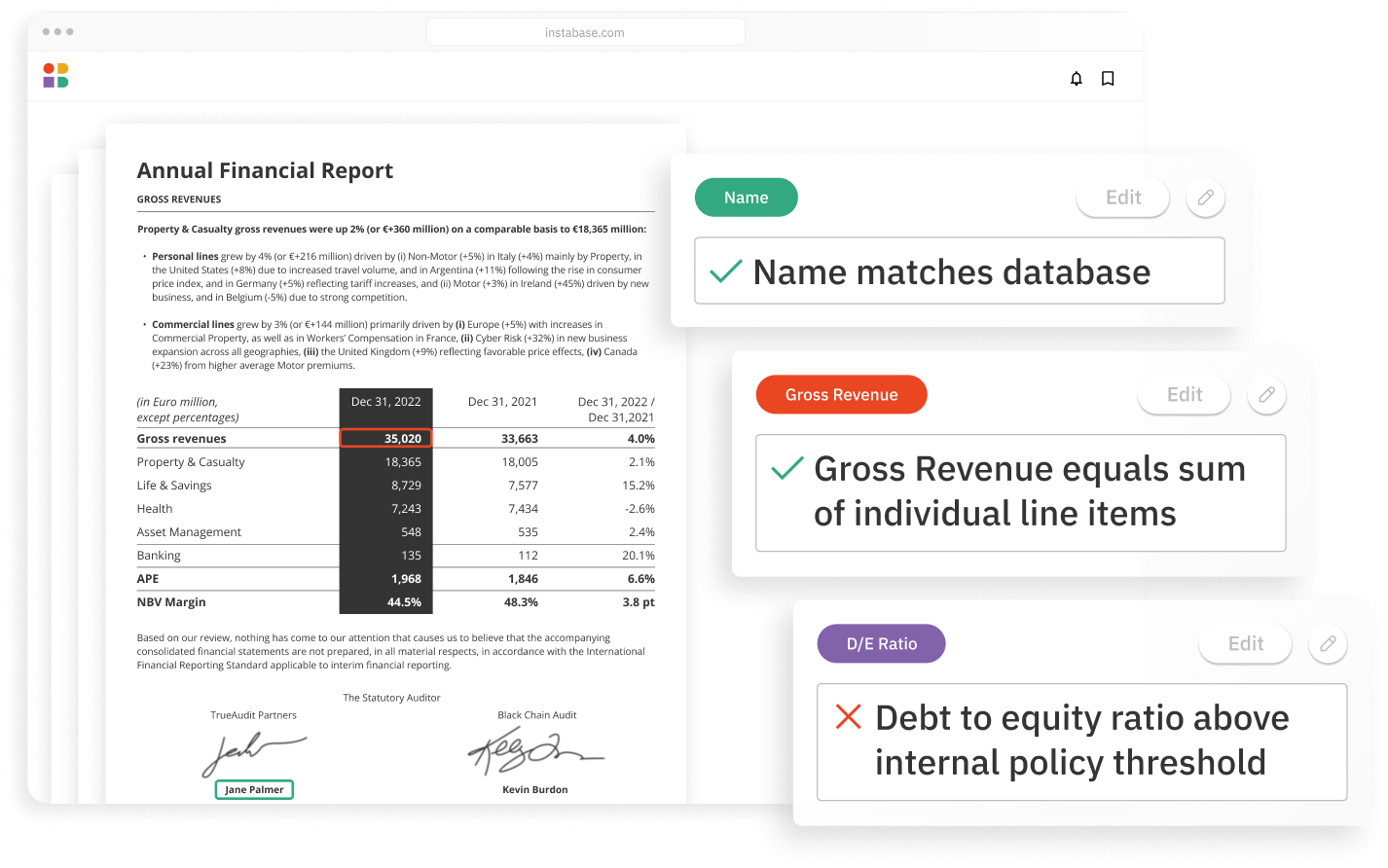

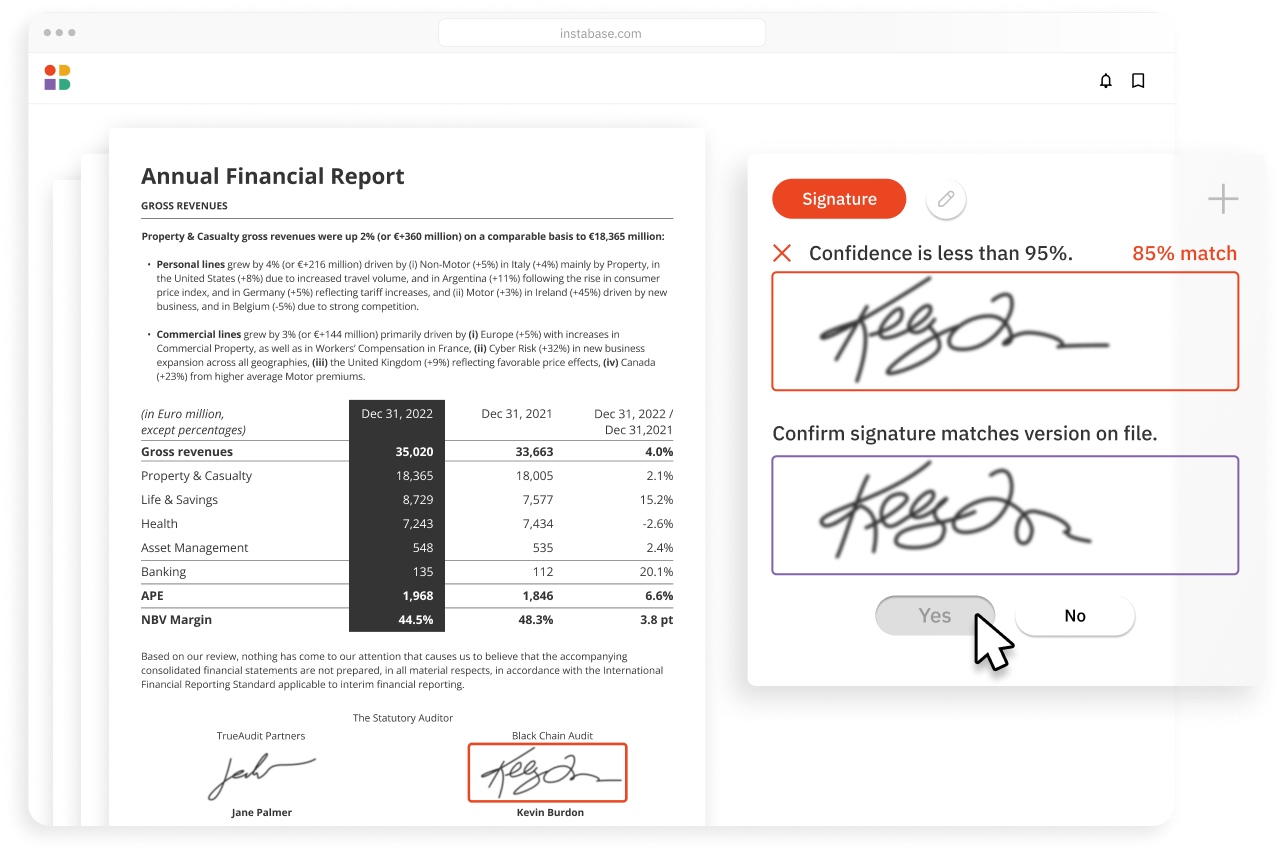

The Instabase Automation Platform for Unstructured Data automatically splits up document packets, digitizes, extracts, and validates borrower data from documents, allowing lenders to achieve a streamlined underwriting process with faster decisions, lower costs, and more scalability.

Accurately automate any document type

- Highly accurate extraction

- Any structure, any language

- Handwriting & printed

Use without any model training

- Out-of-the-box engine

- No model training required

- Configure fields & run

Easily embed into any workflow

- Scalable APIs

- Customize data schema

- Secure environment

How it works

Instabase combines the most powerful technologies for every step of the process, so you can automatically understand any document in the submissions process.