Documents such as Certificates of Incorporation, board resolutions, company returns, tax registration certificates, directors lists, and others in the commercial onboarding process are inherently unstructured, requiring extensive manual review.

Instabase for Commercial KYC and Onboarding

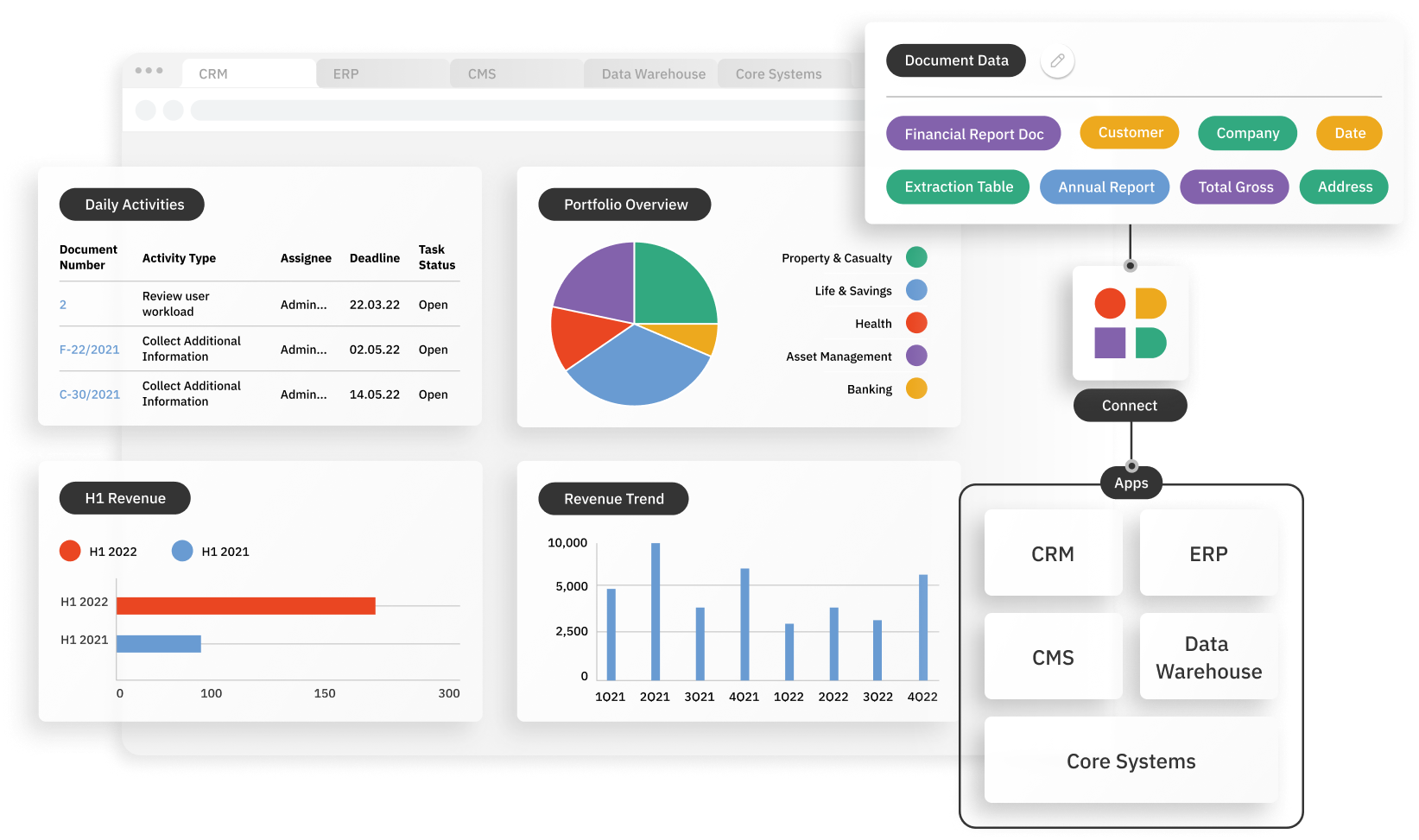

Instabase automates document understanding for each type and format of document involved in commercial onboarding and KYC compliance, streamlining an end-to-end workflow.

Accelerating Commercial Onboarding and KYC

Why Instabase?

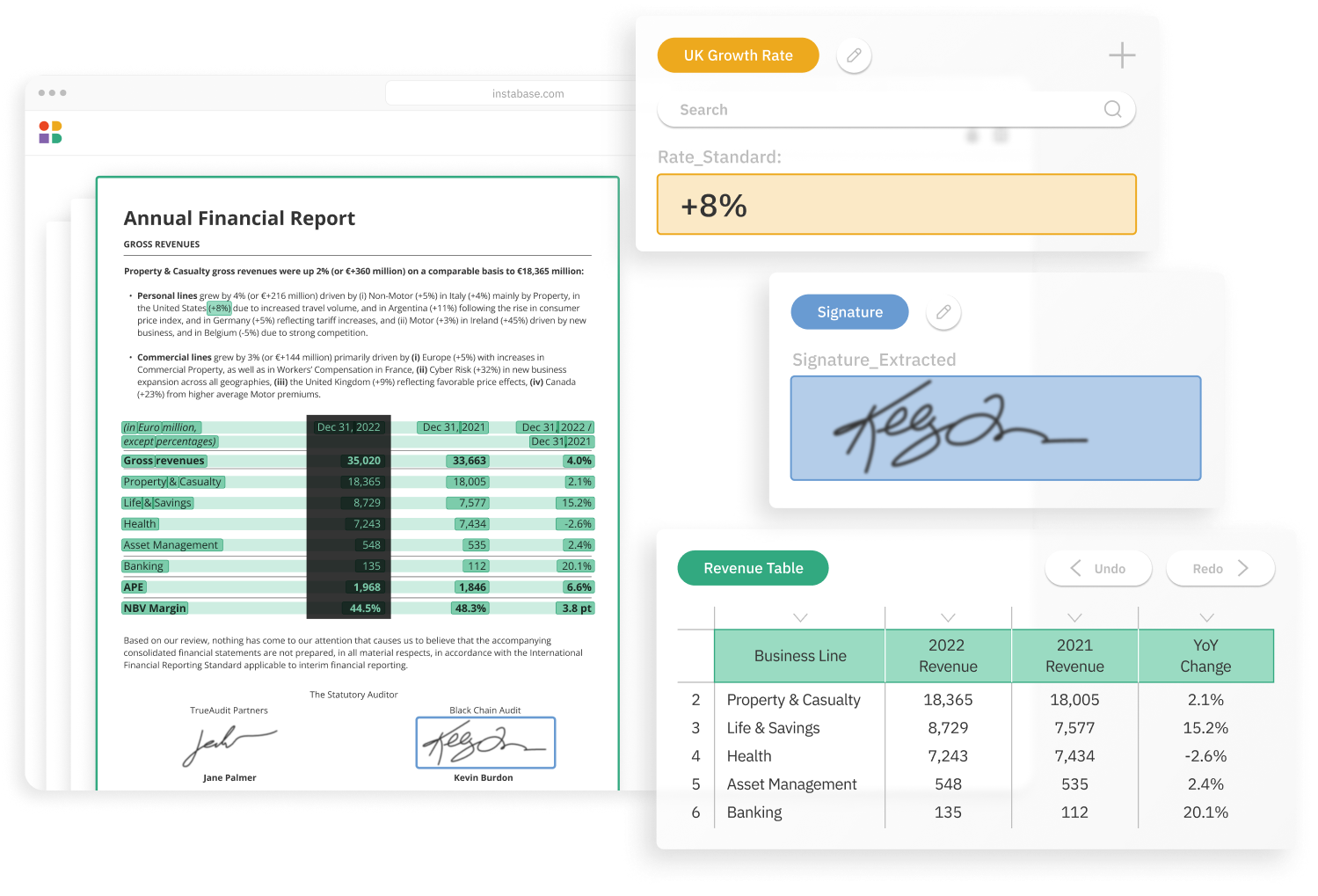

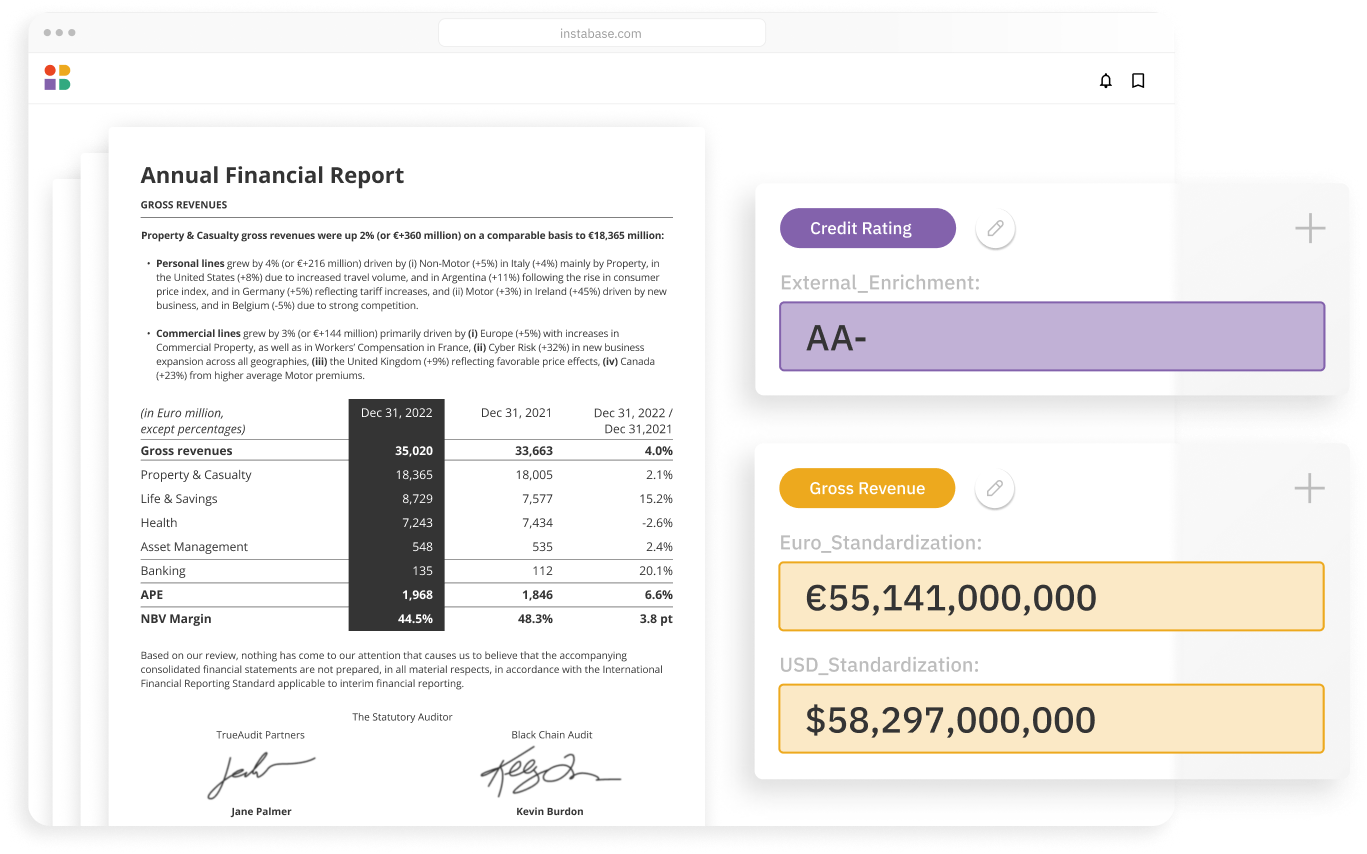

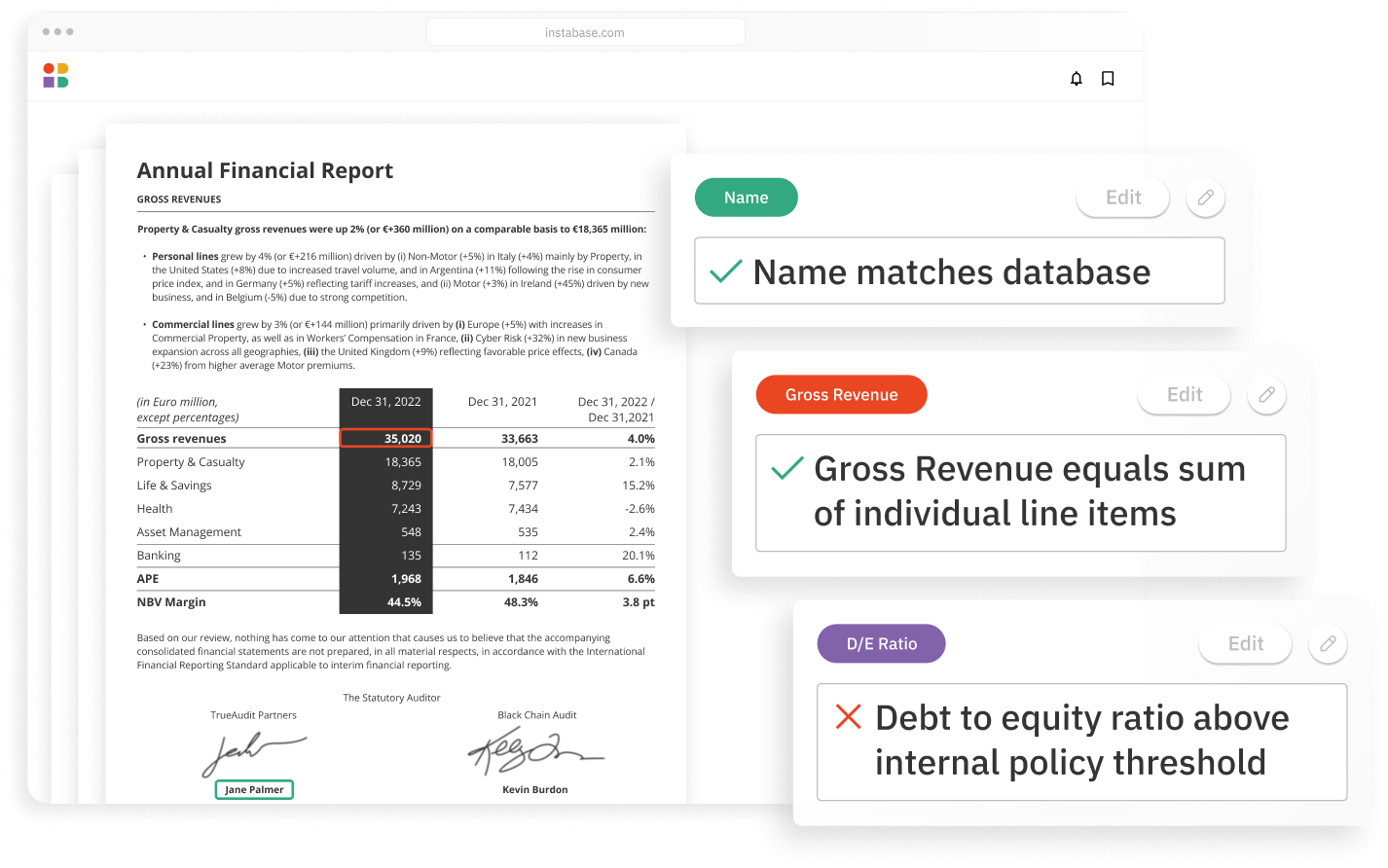

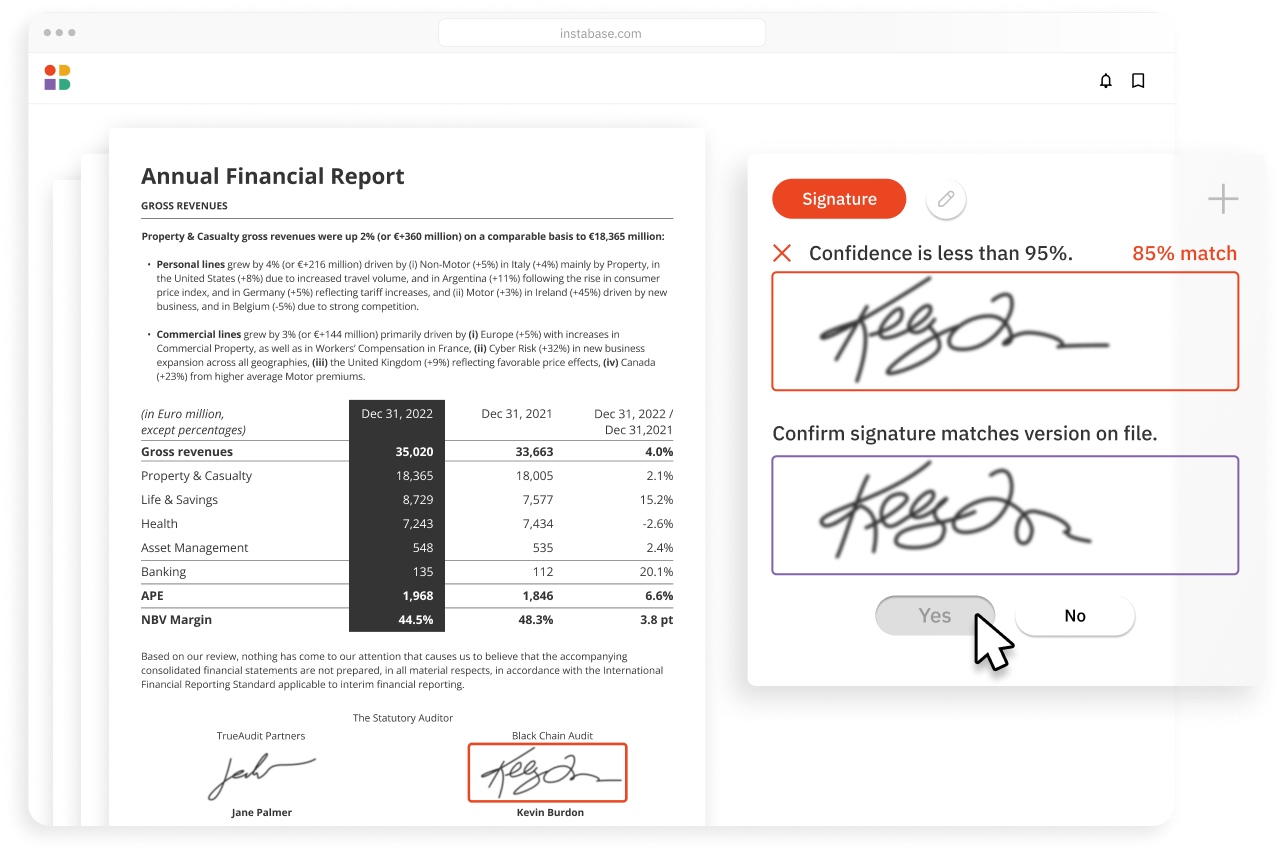

The Instabase Automation Platform for Unstructured Data automates extraction of data and validations across both external and internal sources, for both the company and associated individuals, to help streamline the onboarding process. Organizations can thus have clients join their business faster, speed up time to value, and ensure compliance and regulatory adherence.

How it works

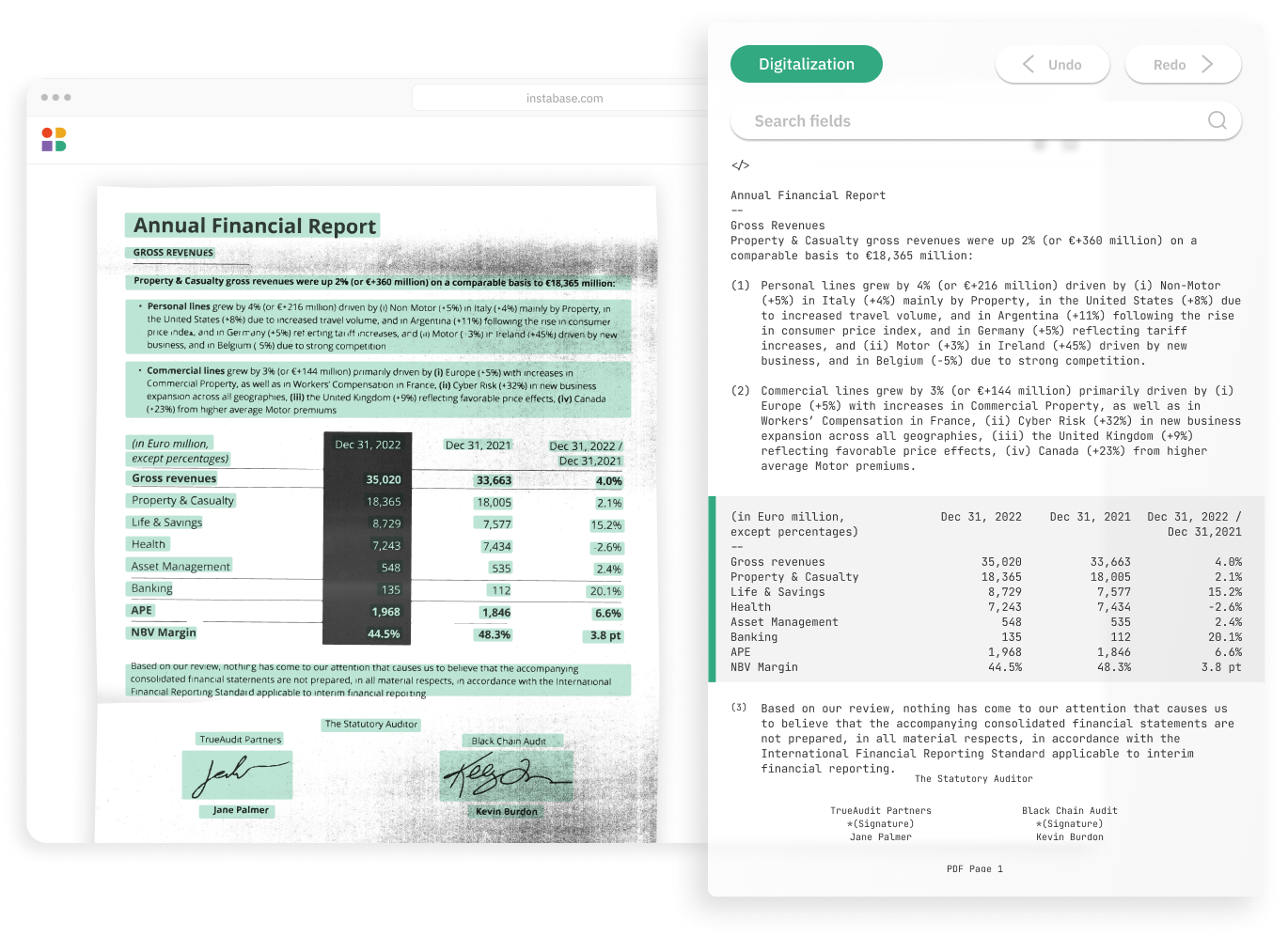

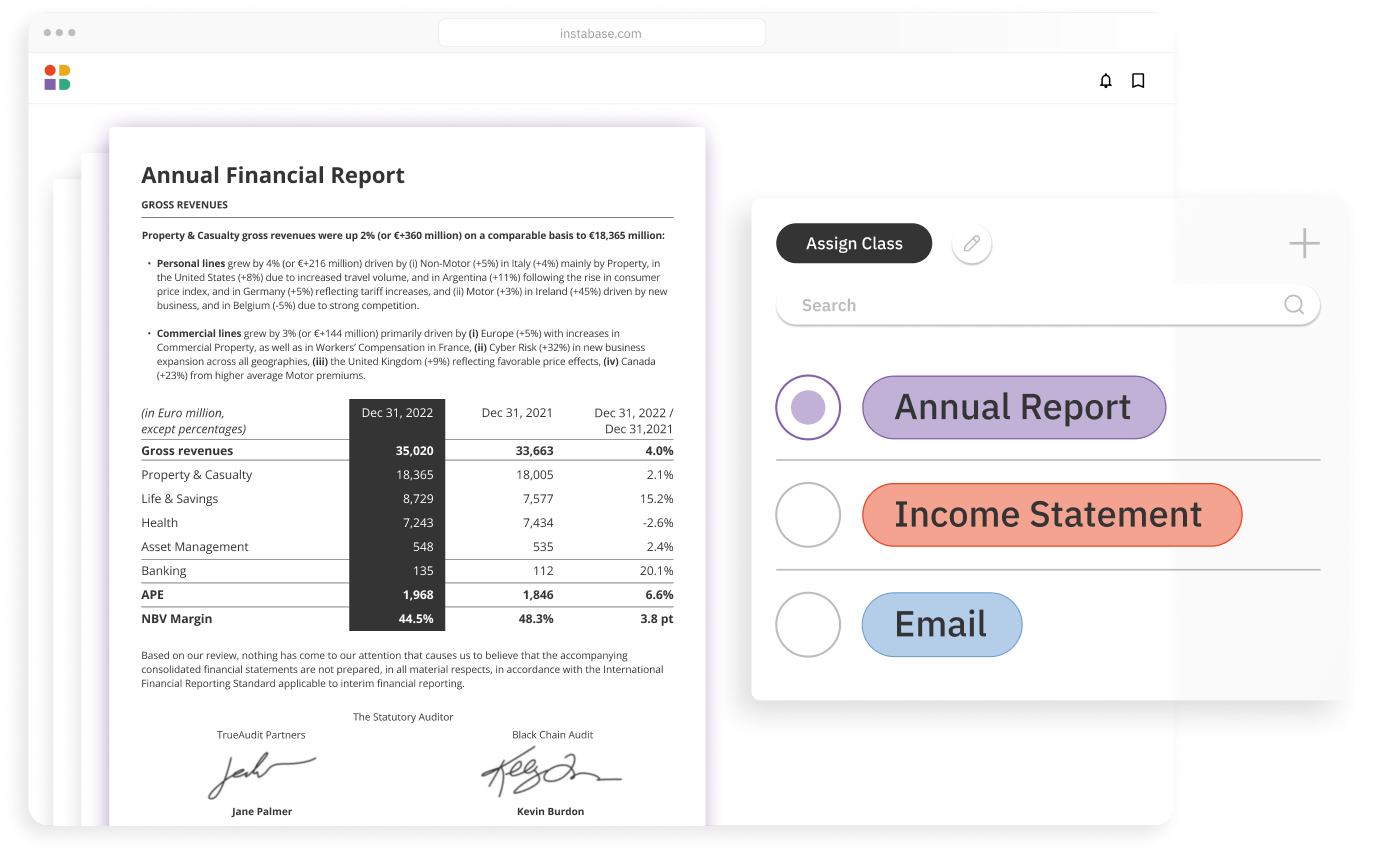

Instabase combines the most powerful technologies for every step of the process, so you can automatically understand any document in the submissions process.