Rising medical costs are a persistent challenge for health insurers. For example, PwC’s Health Research Institute (HRI) projects a 6.5% increase in the cost to treat patients in 2022.

Healthcare payors must find ways to contain costs in their internal processes to help offset the rising medical costs they must pay on behalf of their policyholders. Where can expenses be cut? Which processes can be streamlined?

Unstructured Data Contributes to Greater Costs

Automation saves time, increases productivity, and lowers costs for industries across the spectrum. However, automation is difficult to achieve in healthcare payor operations. Here’s why.

Health insurance payors handle large volumes of unstructured data originating from multiple disparate sources, including healthcare providers, vendors, policyholders, and others. These unstructured documents, many of which are handwritten, require manual processing and data extraction. In a largely paper-bound industry like healthcare, automated intelligent document processing opens up multiple opportunities for cost savings through streamlined workflows.

Here’s an overview of six common ways in which health payors use intelligent document processing to rein in medical costs, make their internal processes more efficient, and uncover deeper data-driven insights.

Use Case 1: Appeals and Denials

When a healthcare insurer denies payment for a submitted claim, providers can appeal the payor decision, indicating why the claim should have been paid. Appeals filings are typically emailed to payors with a variety of forms and attachments included as proof of the medical need. Some of the information may even be handwritten.

The unstructured documents involved in the appeals process are highly variable and are typically handled by manual processing and review. The time involved in manual reviews delays appeals decisions, potentially damaging payor/provider relationships. More significantly, the labor costs involved are high as payors may have a backlog of tens of thousands of appeals in process at any point in time.

Intelligent document processing leverages deep learning technology to ingest, classify, and extract relevant data from highly variable documents. By automating what was once a tedious, time-intensive process, intelligent document processing shortens the appeals cycle, which reduces operational costs and facilitates better payor/provider relationships.

Use Case 2: Prior Authorizations

A prior authorization is a directive or request from a medical professional to preapprove a prescription or certain type of procedure or treatment for an insured patient. Some insurers require preauthorization for specific types of care.

Prior authorization requests are typically sent via fax or physical mail. They often include handwritten notes from providers, patient medical histories, clinical notes, and other highly variable documents. As is the case with appeals, prior authorizations are often manually processed because of the variability and unstructured nature of the documents provided.

Intelligent automation uses deep learning to pull critical data, organize it, evaluate it, and learn patterns from it. As document processing accuracy and speed increase, the time from initial request to authorization is reduced, which helps patients get the care they need faster and reduces operational costs for the payor.

Use Case 3: Provider Onboarding

Onboarding is the process of accepting a new provider into an insurance network and creating a profile for inclusion in member network directories. To begin, a medical practitioner registers as a provider and sometimes registers his or her practice. Registration involves sending information about the provider and the practice or facility, which includes the provider’s name, address, and other contact details.Providers need onboarding to occur smoothly so their profiles will be accessible to patients within the insurer’s network as quickly as possible.

The challenge is that the details included in provider registrations vary greatly and historically have required manual processing. Today, the process can be automated. Intelligent processing expedites the timeline for registration completion and improves the accuracy of provider information in network databases and directories.

Use Case 4: Medical Claims

A medical claim is one of the most basic documents in the insurance process. It is the request from the provider or insured for payment for a covered service. Claims can come in the form of invoices, letters, handwritten notes, and other highly variable document formats. Manual claims processing lengthens the claims cycle and slows payout times to providers or patients.

Intelligent processing speeds up the timeline for claims review and improves accuracy in correctly matching procedure coding with covered services. Accurate claims decisions limit the number of legitimate appeals that payors have to process.

Use Case 5: Commercial Risk Adjustment

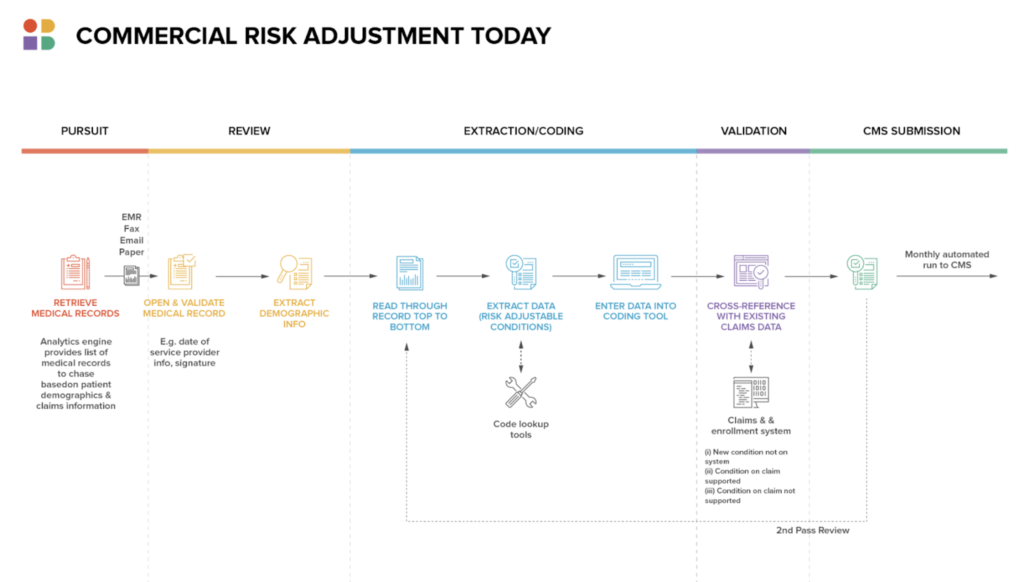

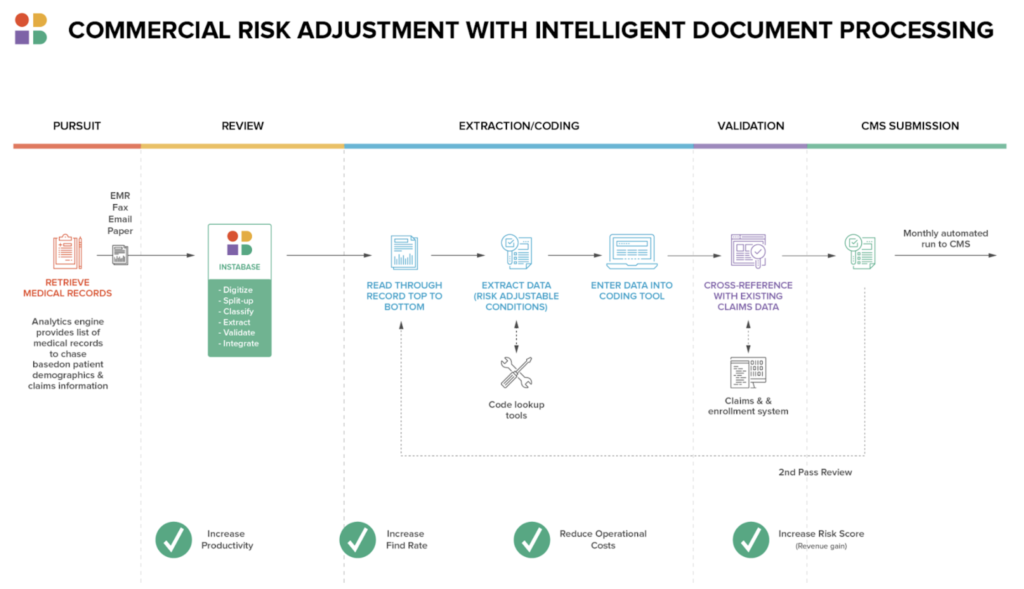

Medicaid and Medicare account for 36.5% of the U.S. health insurance market. One of the most critical areas for intelligent document processing is commercial risk adjustment. This process takes place in Medicare, where the payor is the administrator of plans that are paid by the U.S. Government through CMS.

Payors receive medical records from providers of all services. The payor then adjusts and pays the claim before requesting reimbursement from CMS. Each service is coded with standard medical coding, such as ICD-10 codes, which the payor uses to determine whether a diagnosis or procedure is covered by the subscriber’s plan. Accuracy in records reviews is essential to determine how much money the insurer is likely to get back from CMS. Errors lead to either overpayment or underpayment by the payor.

Intelligent document processing increases the accuracy of records reviews and speeds the process, narrowing the gaps between when the payor pays claims and when the payor receives reimbursement from CMS.

Use Case 6: COVID Certification

Along with the conventional document processing already described, new or variable document processing occurs over time. COVID vaccination cards are a relevant example.

These cards serve as proof of vaccination. They are usually handwritten and conventionally require a manual review. However, with intelligent processing, they are faster to process and data is extracted more accurately.

At some point, COVID certifications will likely become obsolete. However, other limited duration documents like this come around periodically in the insurance sector, adding to the enduring document types already described. Manual reviews on these short-duration documents are especially challenging given the lack of practice and long-established protocols associated with them. Deep learning technology allows for rapid learning for efficient document processing.

Instabase Powers Healthcare Payor Processes

Accuracy, speed, and efficiency are the most critical factors for payors looking to automate their document processing across multiple use cases. All the examples described here are common in the insurance sector, and each involves massive volumes of highly variable documents. Payors are looking for a solution that streamlines their internal processes while still ensuring accuracy.

Benefits of fast, accurate insurance document processing include:

- Reduced costs, which are passed on to the insured and the health system as a whole

- More timely treatment for patients

- Less time spent handling appeals and service calls

- Improved reputation for insurers in the provider network and among subscribers

The Instabase Automation Platform is uniquely designed to deliver the accuracy and efficiency needed to achieve these benefits. Our platform uses deep learning and a unique low-code building block approach to quickly produce highly accurate results for documents of all types.

Get intelligent document processing at your fingertips.

Intelligent document processing at your fingertips.

Streamline payor processes with Instabase today.