Document Automation for Financial Services

The financial services industry is heavily focused on documents. These documents come from a wide variety of sources in all kinds of formats. In a typical financial services scenario, there may be documents such as:

- Proof of identity

- Proof of address

- Investment portfolio statements

- Proof of income

- Payroll data

- Tax returns

- Rental agreements

- Valuation reports

- Credit reports

- Bank statements

This is not an exhaustive list. The sheer volume of documents involved in financial services transactions is staggering, but the challenge is exacerbated by the fact that many of these documents contain unstructured data, which means they are not arranged according to a preset schema or format.

Document automation enables financial services organizations to process all these disparate documents efficiently.

What Is Document Automation

Financial services document automation is the process of applying document understanding technology to automatically extract information from both structured and unstructured documents and make this information available for use. Document automation for financial services largely eliminates the need for time-consuming manual review.

Why Is Document Automation Needed for Financial Services?

Virtually every process in financial services involves some form of document. Many of the documents are highly complex and quite lengthy.

For example, consider just a few of the documents needed to process a corporate loan application. Lenders may require corporate borrowers to provide documents ranging from proof of identity documents for corporate officers to corporate tax returns to copies of the Articles of Incorporation for the business. These documents are quite different in structure and length, but all of them must be reviewed and understood before a corporate loan can be approved.

Financial services organizations routinely deal with large document packets coming in via email, broker portal, postal service mail, and fax. The unstructured nature of most of the documents involved generally necessitates manual review, a process that is time-consuming and costly.

In addition to the time and cost involved, the manual review presents another challenge. To limit the risks associated with providing financial services, documents must be accurately reviewed. Data taken from each document must be correct and meticulously distributed for use in downstream systems. Otherwise, decision-making can be negatively impacted and accurate risk management becomes a challenge.

Document automation with a highly accurate document understanding solution can:

- Slash the costs associated with a manual review

- Shorten the time to decision or response

- Elevate customer experience

- Enable financial services organizations to scale operations without scaling associated costs

Historical Technologies for Document Understanding

With all of these potential benefits, why have financial services organizations been reticent to adopt document automation? In some cases, it is because document understanding technologies, until recently, have been lacking in flexibility and accuracy.

Some of the first document-understanding technologies included solutions that were template-based or rules-based. These technologies work well for structured documents, which adhere to strict formatting (ie. static form fields). However, template-based and rules-based solutions simply cannot accurately process unstructured documents.

Optical character recognition (OCR) technology has also been used for document understanding, but it, too, is limited in what it can accurately interpret from a document. For financial services, where accuracy is key, more is needed.

Today, machine learning technology and a subset of machine learning known as deep learning enhance the document automation technologies of the past, improving accuracy and processing both structured and unstructured documents at a fraction of the time and expense it takes to manually review documents.

Deep learning leverages natural language processing (NLP) technology along with machine learning models trained on thousands of document types to quickly ingest, split up and classify, and extract key data from documents and then automatically send that data to the appropriate downstream systems for use.

For more information about how deep learning works for document automation, download your free copy of “The Ultimate Deep Learning Guide for Unstructured Data.”

Machine Learning and Deep Learning Use Cases Today

To understand the power of machine learning and deep learning applied to document automation for financial services, here are three popular use cases to consider:

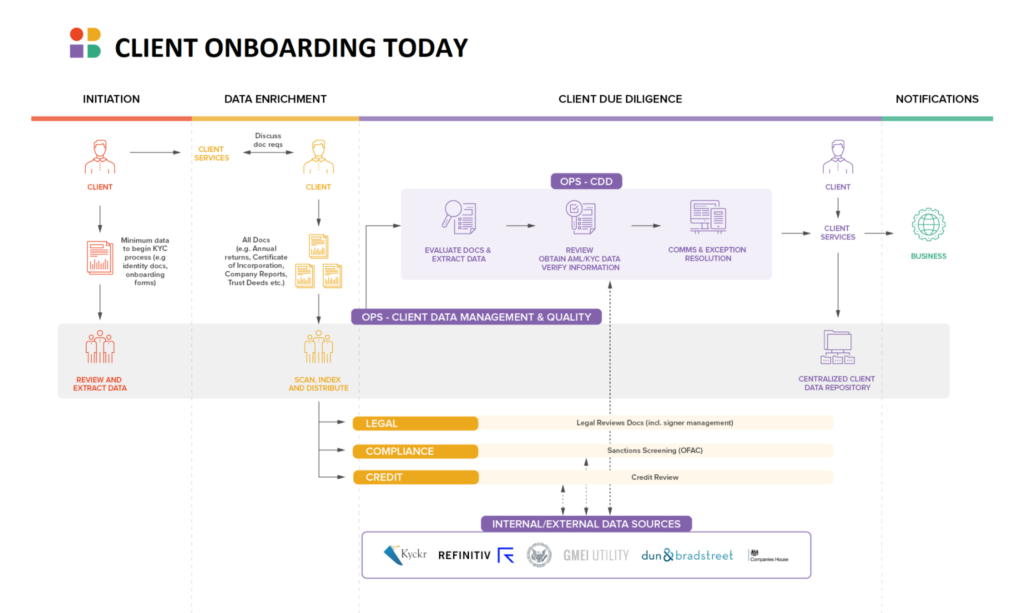

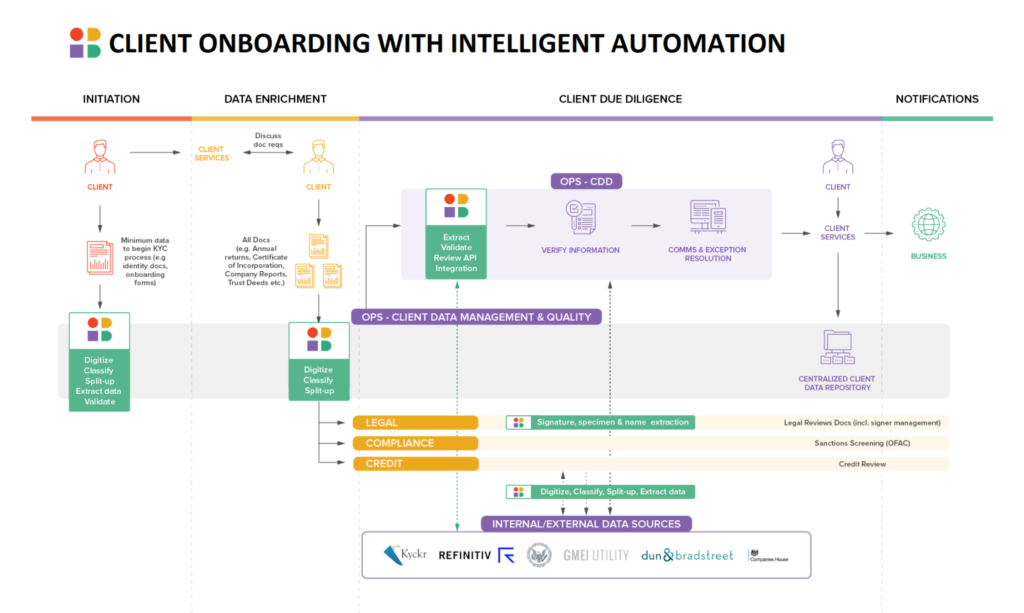

1. Client Onboarding with Document Automation

From a logistical perspective, client onboarding is a documentation and compliance challenge. Many financial services organizations employ teams of professionals to ensure compliance with various laws, including complicated Anti-Money Laundering (AML) and Know Your Client (KYC) regulations.

As a financial services organization grows, adding more workers to handle increasing onboarding challenges is not a sustainable solution because it is both prohibitively costly and time-consuming.

Document automation enables financial services organizations to scale their onboarding processes without scaling operating costs. For organizations looking to do more with less, document automation holds the key. It significantly reduces and, in many cases, eliminates the need for tedious manual review.

Learn more about how document automation for financial services can speed onboarding and help with compliance.

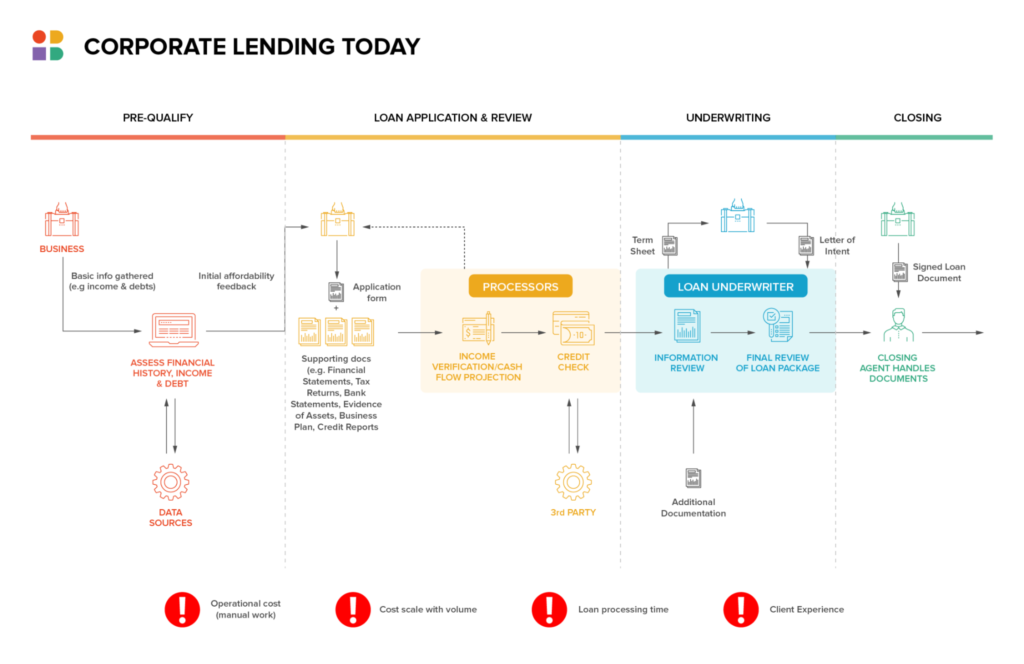

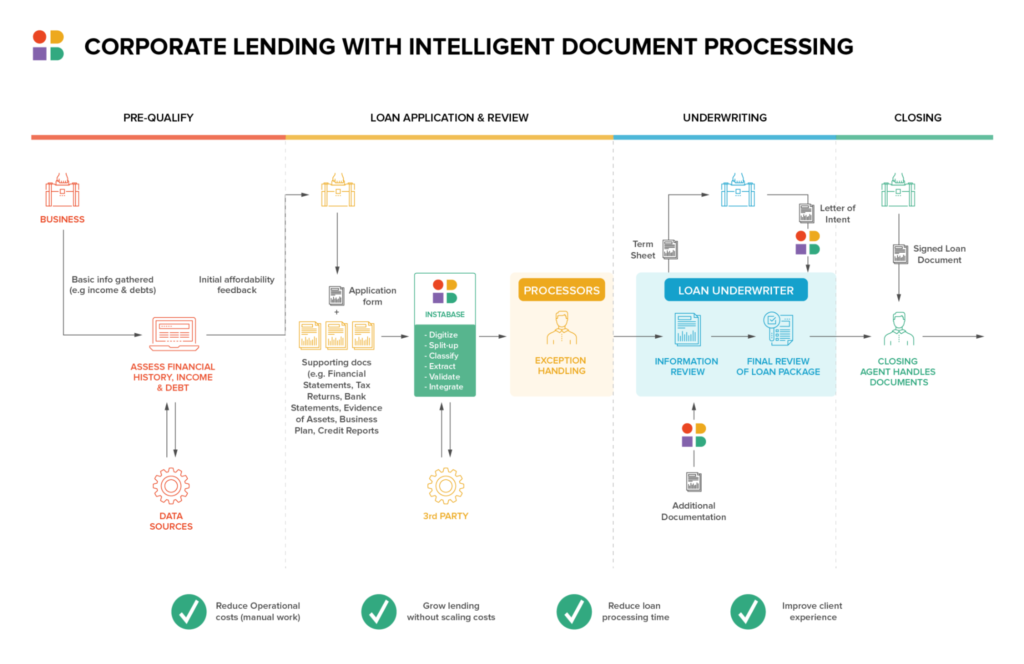

2. Commercial Lending with Document Understanding

Intelligent document understanding can improve operational capacity and risk visibility for commercial lenders. Corporate lending without document automation involves a prodigious amount of manual document review, which is costly and inefficient.

Commercial underwriters need several complex documents and data to complete their review processes. To underwrite a higher volume of loans while maintaining effective risk assessment practices, lenders can turn to intelligent document processing solutions to speed the underwriting process and eliminate inefficiencies.

3. Investment instructions with Document Automation

Another highly document-intensive process for financial services organizations involves investment instructions and their management. Investment instructions often include amendments, supplements, and addendums that must be accurately archived and maintained in a compliant system of record.

Document automation enables financial services organizations to accurately capture, aggregate, and maintain investment instructions and their associated documentation for compliance and audit purposes.

These are just a few examples of the way document automation for financial services enables financial institutions today to streamline processes and gain efficiencies while providing excellent customer experiences.

How Instabase Helps

The Instabase Platform provides a revolutionary approach to document automation. Instabase leverages deep learning technology and natural language processing, combined with low-code building blocks to help financial services organization ingest, classify, split, enrich, validate, and push out relevant data to downstream systems in a structured format.

With Instabase, financial services organizations can:

- Eliminate or greatly reduce most of the costly, tedious manual review of unstructured documents.

- Extract relevant data from unstructured documents with a high degree of accuracy.

- Speed the delivery of excellent customer experiences by eliminating process bottlenecks.

- Scale quickly, adding capacity for more business without adding associated employee costs.

Learn more about intelligent document automation for financial services in The Big Book of FSI Use Cases and our financial services solution page.