98%

accuracy maintained throughout

30

days to deliver working app

20%

cost savings realized out of the gate

A Tier 1 Investment Bank accelerated their settlement operations automating the Standard Settlement Instructions process for its clients – eliminating manual review to focus on client experience.

Becoming the bank of choice for institutional clients

One the world’s largest financial institutions was looking at ways to ensure it could settle its transactions with clients in a safe, secure and timely manner. A major bottleneck was the process to collate, interpret and action the Standard Settlement Instructions (SSIs) that their clients sent in. These instructions representing the final destination for the transfer of securities or cash between financial institutions. The documents outline crucial information, and therefore maintaining high levels of accuracy is paramount in the process. As the clients dictate the format that the share the details, the investment bank had to manually process each document in order to deliver.

The transformation from manual to automated

Prior to working with Instabase, the bank had attempted to transform its processes on a number of occasions – including researching automation in-house and other AI opportunities. Attempts using legacy tools available in the bank actually had the inverse outcome, with costs to develop and maintain technology solutions outweighing any savings from automation.

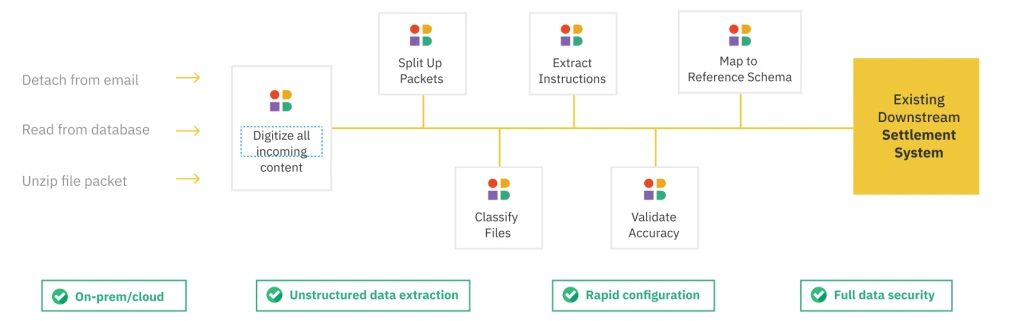

Given the highly variable nature of the documents, leveraging Instabase’s modular approach proved to be the only option that could truly move the needle. The two teams quickly configured an app that was able to combine extraction from unstructured natural language, tables and penmarks to produce a structured data output that could be relied on.

Data had to be captured from multiple different file formats, converted to a standard format, fields extracted, accuracy validated and then mapped for the downstream payments schema.

Rapid results without compromise on accuracy

In only four weeks, the teams had configured an app that was already providing value. Using the configurable confidence toolkits on Instabase, an accuracy rate of 98% was maintained across the documents.

Across the bank’s top 25 clients, average handling time was reduced by 20% out of the gate unlocking substantial operational savings. The initiative sets the bank up to grow the business in a scalable way without worrying about costs rising in line – and enabling colleagues to serve customers rather than review documents.