Some types of insurance carry greater risks than others and therefore require more rigorous underwriting processes. Even within a broad category such as life insurance, some policies come with greater risk.

For example, whole life insurance, sometimes referred to as universal life insurance, is often among the best revenue generators for an insurance firm, but it comes with a higher risk. That higher risk puts the onus on underwriters to be particularly vigilant in the review process. Full medical underwriting requires a significant amount of document review, most of which has been accomplished manually in the past.

However, considering that underwriters in this space are among the most highly compensated workers in the insurance industry, it makes sense for carriers to find a way to reduce manual review and free underwriters to concentrate on risk assessment rather than data entry and paperwork.

Leveraging a document-understanding platform with built-in deep learning technology can help insurers automate the review process and save time and money.

The Instabase Automation Platform for Unstructured Data uses deep learning to automate and streamline the underwriting and policy issuance processes. For forward-thinking insurers, it’s a game changer. Here’s how.

Reduces Operational Costs

Because it covers the insured up until the moment of their death, whole life insurance is typically many times more expensive than term life insurance. The latter lasts a specified period and only pays out if the insured dies during that time. Part of the increased cost of the former is due to the tremendous operational costs that go into managing its policies.

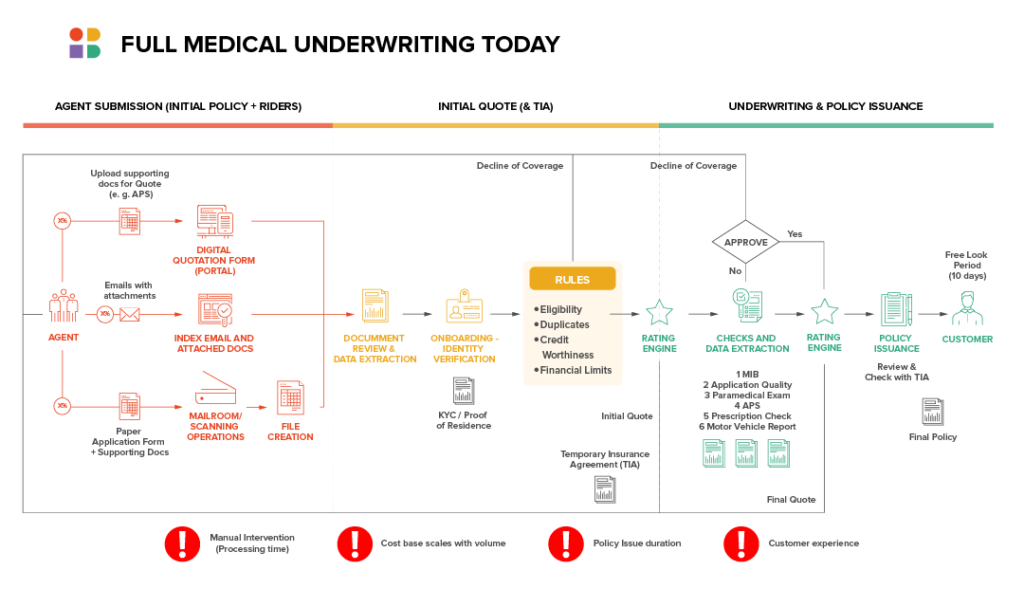

When preparing to insure an individual for whole life insurance, an insurer “will do something called full medical underwriting,” said Instabase Insurance Industry Leader Bastiaan de Goei.

“The insurer will want to understand your physical health a lot better” than they would for term insurance, said de Goei. “They do this by sending you to a doctor and performing some tests, including a full physical, taking and analyzing a blood sample and more. … All of that takes time, and once the reports come in from a doctor or a hospital, those reports are highly, highly unstructured.”

Unstructured documents present a major obstacle for organizations using rules-based document understanding technologies, necessitating tedious manual underwriter review.

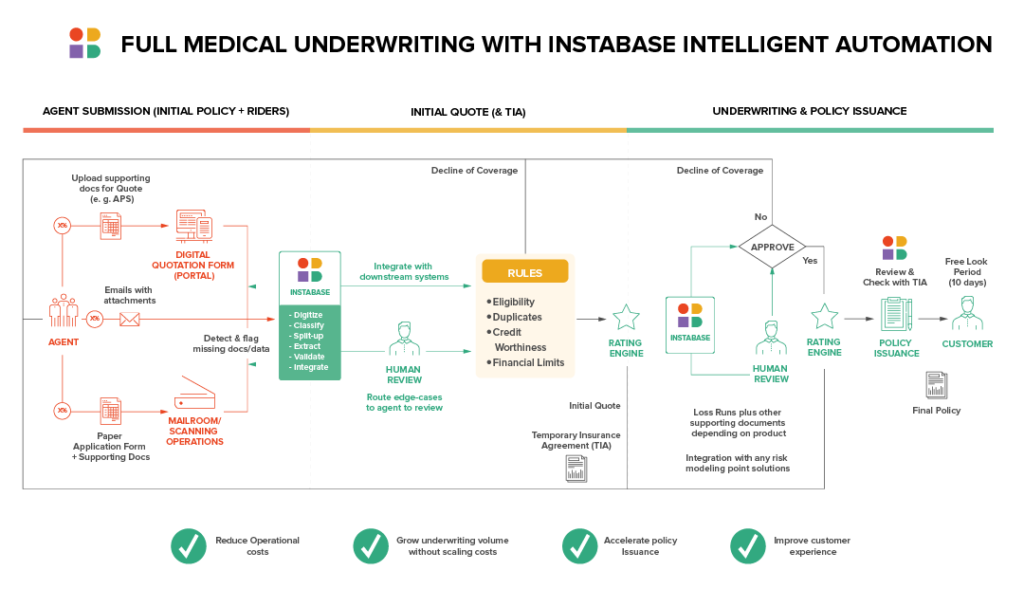

Using deep learning technology, Instabase automates the review process, extracting specific data points–including those relating to potential risk on the part of the insurer (such as high body-mass-index numbers and elevated blood sugar levels). Extracting this level of detail automatically means that an insurer can slash the number of hours used by its highly compensated underwriters, greatly reducing its operational costs.

Further, freeing up underwriter time and brain power by implementing Instabase can increase the capacity of those underwriters by up to 50%, according to de Goei.

Accelerates Policy Quote and Issuance, Improving Customer Experience

Generally, whole life insurance policies are purchased through agents, who collect initial information from the policy buyer. This entails the submission of various documents that then must be reviewed and classified, including:

- Application forms

- Attending physician statements

- Prescription-drug checks

- Motor vehicle reports

When these documents have all been thoroughly reviewed and approved, the carrier can issue a temporary insurance agreement to the buyer. Then the lengthy underwriting process really kicks into high gear, involving “a lot of manual labor,” de Goei said. The underwriter must spend hours going through thousands of pages “to basically find a few values.”

This human-heavy process is prone to error and highly time-consuming, which can test the patience of the policy purchaser and lead to poor reviews and loss of business for the insurance company.

Using Instabase to digitize, split up, scan, classify, extract and validate relevant data points can reduce document processing time by up to 85%, de Goei said. That’s a sizable saving that can go a long way toward improving the customer experience, which can help the insurer retain business.

Helps Insurers Scale without Adding Costs

Working with the Instabase Automation Platform also allows an insurance company to grow its book of business without adding the costs that typically come with scaling. Instabase’s natural language understanding capabilities can look for specific keywords and health conditions of particular importance, letting underwriters focus on the relevant pulled data.

“Underwriters are typically under service level agreements with agencies and brokers, so they need to come back within a certain amount of time with a quote” for the policy buyer, de Goei added. “So the faster you can do it, the better your relationship with the broker or agent will be, and the better the business will be for the insurance firm. It’s actually really important for the health of a life insurance business.”

Want to streamline your full medical underwriting process? See how Instabase can provide workflows without the wait.

Workflows without the wait.

Instabase building blocks let you create powerful workflows in record time.