2021 has been a challenging year so far for consumer lending. Still reeling from the fallout of a global pandemic, financial institutions are dealing with rapidly changing regulations, seismic shifts in employment numbers, and continuing economic uncertainty.

However, there are signs that brighter days are ahead. For instance, in the U.S., job growth ticked upward in March, and many economists expect April to have been a banner month for job creation, adding an additional 1 million paying positions to the economy. Despite recent concern about loan delinquency being on the rise, Advisor Perspectives notes: “Total consumer debt outstanding is up a modest 2.7% year over year, and performance has improved in auto loans, credit cards, consumer loans, and student loans. Things seem to be looking up for consumers. The US has made rapid progress with COVID-19 vaccinations, which should help the economy return to full capacity in a matter of months.”

At full capacity, however, consumer lenders may struggle to keep costs down while simultaneously growing their business base. An evolving lending ecosystem calls for evolving technology. Here’s a look at how Intelligent automation can help take the load off consumer lenders as they seek to scale.

Intelligent Automation Slashes Manual Review Processes

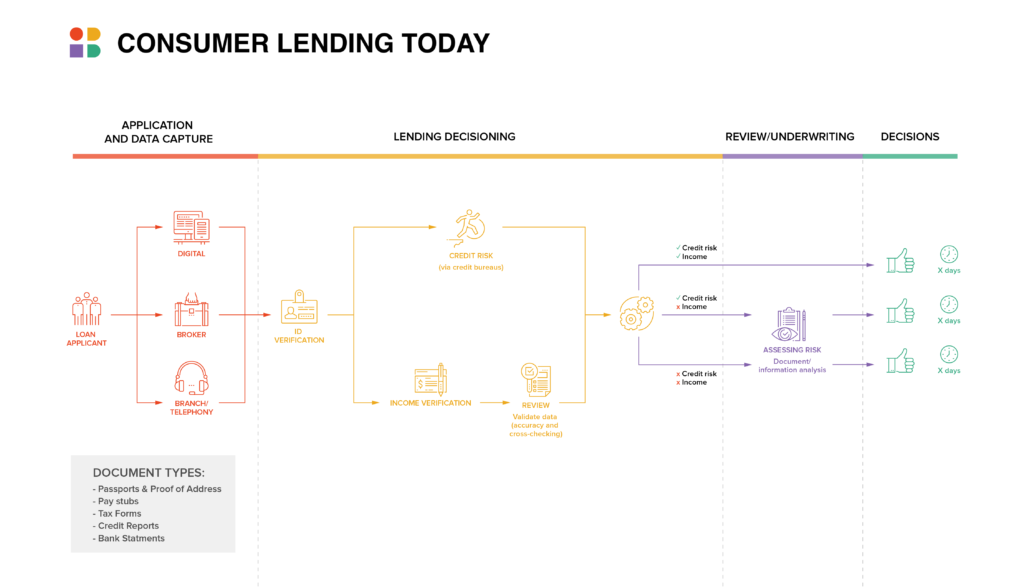

The lending process has never been quick or easy for either borrowers or lenders. Borrowers must submit documents like pay stubs, tax returns, bank statements, and credit reports, all of which come in a variety of disparate formats from a variety of entities.

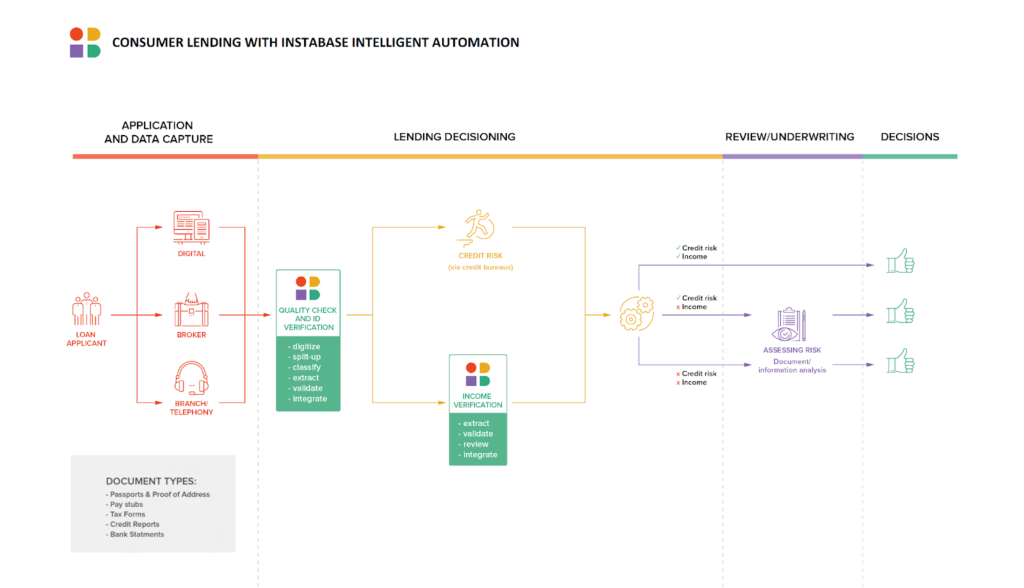

Document-understanding software can take much of the sting out of data capture and review. It automates the review and pre-populates fields, eliminating the need for a human worker to perform these laborious tasks manually, so lenders can approve more loans without adding to personnel costs.

Intelligent Automation Speeds the Approval Process

It’s a domino effect of the positive kind. By facilitating a streamlined approach to data capture, validation, and integration, intelligent automation solutions enable lenders to get back to applicants with decisions more quickly. This not only gets borrowers their funds sooner, but it confers a significant competitive advantage because, in consumer lending, speed is key to customer satisfaction. In turn, customers are more apt to refer friends and family to lenders who offer a satisfactory customer experience.

Intelligent Automation Flags Risks Sooner

With the help of intelligent automation, underwriters at financial institutions are able to focus their time and efforts on risk assessment, which has a direct impact on the lender’s balance sheet. A review-weary employee is more likely to miss application errors, inconsistencies, or data points that spell trouble for the lender. By contrast, intelligent automation is never weary. Document understanding software finds and flags potentially problematic fields for manual review. This ensures that discrepancies and mistakes are caught sooner, while also giving underwriters back hours of time that was once spent in manual review of all documents. And that saves the bank time and money.

Discover how Instabase can streamline your consumer lending processes.. Get a demo today.

Workflows without the wait.

Instabase building blocks let you create powerful workflows in record time.