Borrowers want decisions about their requested funds soon after they apply for them–and the responsibility to facilitate fast, fair decision making about said loans rests with the lender. The financial institution must be not only speedy but also thorough and compliant during applicant background checks, perhaps especially so during the income verification phase.

Unfortunately for many lenders, income verification is an area that remains bogged down by manual processes. These operations consume personnel hours, slow down business workflows, and frustrate customers.

Automated document understanding can radically change the face of lending for those banks still slogging through application packets by hand. Here are the top three ways an intelligent automation platform can greatly improve and speed the income verification process.

Reduces Manual Review Costs

Underwriters who are constantly focused on filling out various digital-form fields in their lending systems and going back to potential customers with questions regarding applications are not able to make rapid, intelligent decisions. Instead, their work hours are eaten up by processes that could be automated.

Reducing manual review hours results in significant savings for the lender from the human capital perspective. Underwriters are highly trained professionals, and their labor costs can mount quickly. By automating much of the income verification process, lenders eliminate wasted underwriter time, enabling the financial institution to utilize underwriters more effectively in pursuit of higher-level tasks such as strategic decision making.

Produces Answers Sooner

“Remarkably, up to 35 percent of customers in certain segments (e.g., repeat home buyers) select a lender within just three days after starting their search,” a McKinsey & Company piece on banking noted. “They want to complete the application quickly and, if they already have a relationship with the lender, they expect the lender to use the financial data it already has rather than ask them for more documents. Naturally, borrowers also want a quick conditional decision and fast time to close.”

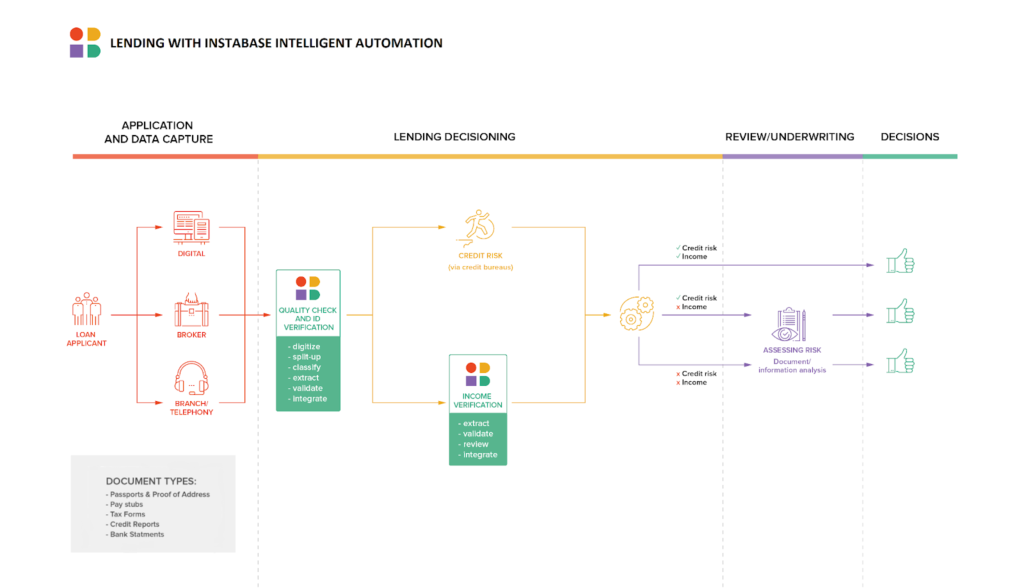

Because it allows banks to split up and classify large packets of incoming documentation and extract, validate, and prioritize needed information from those documents, the Instabase Automation Platform enables financial institutions to access what they need sooner. Using AI-powered document understanding, banks can better and more quickly ‘digest’ all the information coming from customer checking account statements, pay stubs, tax returns, and other income documentation, no matter what format the documents have. That means downstream decisioning happens faster, and customers get their answers sooner, which is of paramount importance to them.

Increases Accuracy

“Getting things right the first time” is also important to borrowers, according to the same McKinsey article. No customer relishes the back-and-forth data dance that often accompanies the lending process.

Part of the reason for the frequent requests for further information during the income verification process is that the documentation submitted arrives in highly variable formats, often unstructured, leading to confusion or errors on the part of the lender.

Instabase automatically extracts key fields no matter what the document type or where in the document the needed information is located. It also flags potentially problematic fields for targeted review so that operations agents are alerted and any issues can be addressed quickly. Greater accuracy leads to faster decisioning, which leads to quicker turnaround and higher business volume.

Leverage the Instabase Automation Platform for Income Verification Success

Instabase streamlines the income verification process with three building block features. The platform:

- Splits up and classifies incoming application packets

- Extracts information from both structured and unstructured data sources

- Validates output and flags targeted review when necessary

Automate your income verification processes with the Instabase Automation Platform for Unstructured Data today.

Automate income verification.

Use the Instabase Automation Platform to streamline your processes.