Reviewing and handling bank statements is a time-consuming process that usually involves employees manually reviewing information, cross-referencing information against other data, and inputting data from statements into various systems. Optical character recognition (OCR) technology offers a better solution that makes this more efficient and accurate, while also freeing up employees to focus on more analytical or customer-facing tasks.

Let’s take a look at how companies can apply OCR to bank statements, different use cases for this technology, and how to use Instabase’s AI tools for bank statement OCR.

What Is Bank Statement OCR?

OCR is a technology that recognizes printed or handwritten text in digital images and converts it into machine-readable data that can be edited and searched. You can use OCR to extract text from various types of documents, such as scanned paper documents, PDF files, and images.

Text-heavy documents like bank statements are great candidates for OCR. OCR tools can quickly scan documents and extract vital information like account numbers, transaction details, and dates. You can either extract data from the entire statement or select the specific areas of the statement that you’d like to extract. From there, you can then copy and paste the extracted information into another document or system.

Bank statement OCR saves time while reducing the margin for human error associated with manual data entry. By making bank statement data searchable, OCR also enables companies to more easily identify patterns or trends that might signal fraud.

Although OCR sounds highly beneficial, it also has its limitations. Accuracy is a major challenge and some solutions struggle more than others. Providing the OCR tool with a clear, high contrast document is the best way to achieve a high accuracy rate. However, accuracy decreases if there’s handwriting, the scan is low quality, the text is distorted, or the document has a complex layout. Text that’s extracted using an OCR tool still needs to be double checked to ensure that it’s accurate.

Another challenge with OCR is that it doesn’t preserve the formatting of the data, so you need to reformat the extracted data. Bank statements are highly structured, containing multiple sections of formatted content and a table of transactions. Bank statement OCR doesn’t preserve tables, text styling, text alignment, and line breaks. Instead, it produces a large block of data that you’ll need to clean up.

Despite these challenges, OCR is still a useful tool for efficiently processing bank statements and reducing manual work.

7 Use Cases for Bank Statement OCR

Banks, lenders, and any company that reviews bank statements can benefit from OCR bank statement technology. Here are seven example use cases that can improve your workflows.

Income Verification

To initiate a mortgage, consumer loan, or commercial loan, lenders need to verify the borrower’s income and assess their ability to repay the loan. This involves reviewing bank statements, paycheck stubs, and other documents that are filled with data. Customers want to hear back from lenders quickly, but income verification is a tedious, manual process that consumes a lot of time and is frustratingly slow for customers.

Bank statement OCR speeds up the income verification process by automatically extracting the needed information from bank statements and other documents submitted by the borrower. The information can then be verified and used to determine the individual or business’s creditworthiness.

Know Your Customer

Know Your Customer (KYC) is a key step when financial services companies onboard new customers that helps prevent money laundering, fraud, and other financial crimes. Companies need to gather a number of documents from their customers, including IDs, bank statements, employment letters, tax documents, and more. Then, they process these documents to verify the customer’s identity, understand their risk profile, and confirm that the customer meets the company’s requirements. By building an accurate customer profile, financial institutions can also detect potential fraud, unauthorized account access, or unusual trends or transactions for the duration of the relationship.

Using bank statement OCR technology streamlines the onboarding process by quickly and accurately extracting data, which can then be reviewed, compared against third-party data, supplemented with additional information, and inputted into other systems for further action and recordkeeping. Financial services companies can verify a customer’s identity faster, leading to a smoother onboarding and happier customers.

Insurance Claims Processing

Insurance companies may request bank statements as part of the claims process in order to confirm that you own the damaged or lost item or identify insurance fraud.

OCR automatically extracts specific transactional data, which you can cross-reference with claims information or use to assess whether the claim is legitimate. This reduces the time spent manually reviewing claims, allowing customers to receive payment faster.

Accounting and Financial Reconciliation

Traditionally, reconciling accounts involves carefully examining a mountain of receipts, invoices, and other documents. Businesses need to spend countless hours manually comparing and checking transactions.

Feeding these documents into OCR technology helps companies automate accounting and financial reconciliation. They can extract line items, dates, and dollar amounts from bank statements and easily match them up to other records.

Source of Funds

To comply with Anti-Money Laundering (AML) laws, financial services companies need to confirm the source of their client’s funds. Source of Funds verifications require customers to provide their bank statements, among other documents, for scrutiny.

Using OCR, employees and AML systems can not only efficiently extract and analyze data from bank statements, but also pay stubs and legal documents.

Tax Audits

Lengthy tax audits involve years of financial documentation, which can take days or weeks to comb through. OCR speeds up the process by digitizing massive volumes of text-based data, giving it structure and making it possible to search for specific data points. Auditors can quickly spot discrepancies and irregularities in bank statements and tax declarations, reducing audit time and the amount of resources needed.

Bereavement and Offboarding

When an employee loses a loved one, OCR can help administrators issue bereavement benefits while reducing the burden on already overwhelmed individuals. Admins can verify an employee’s benefit eligibility, extract data from death certificates or obituaries, and speed up paperwork.

Likewise, if an employee terminates their employment or passes away, OCR can help admins navigate the complex paperwork and requirements to effectively offboard the employee. This involves revoking access and privileges, digitizing exit surveys and resignation letters, and updating payroll and benefits records, for example.

How to OCR Bank Statements With Instabase AI Hub

Manual processes impose limitations on how many statements can be reviewed and the accuracy of those reviews. Using OCR and more advanced technologies, like generative AI, companies can lift those limitations and go through huge volumes of bank statements with a high degree of accuracy.

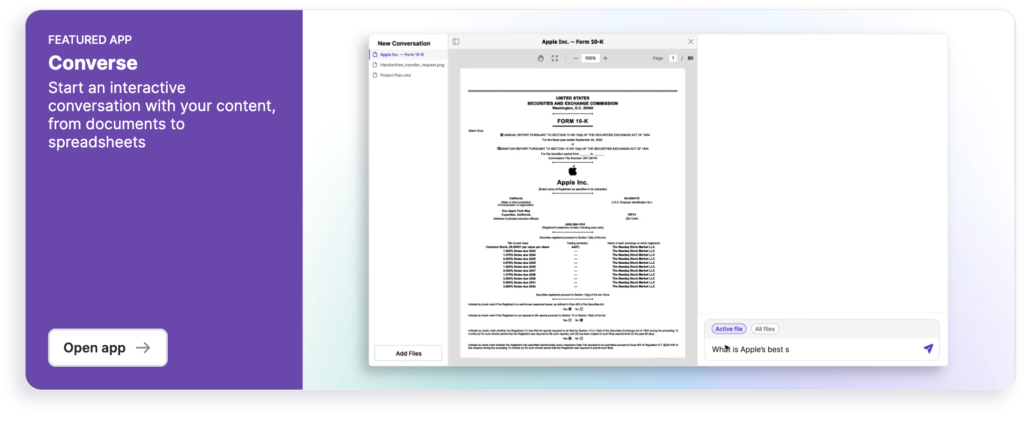

Instabase AI Hub offers turnkey, user-friendly AI applications built for extracting, analyzing, and structuring data from documents. Its capabilities go beyond traditional OCR, giving companies the ability to interact with the content trapped in their paper and digital documents, specify what they’re looking for, and format their data in whichever way they’d like. Instabase leverages large language models (LLMs) and retrieval-augmented generation (RAG) so that you can do all of this through natural language prompts.

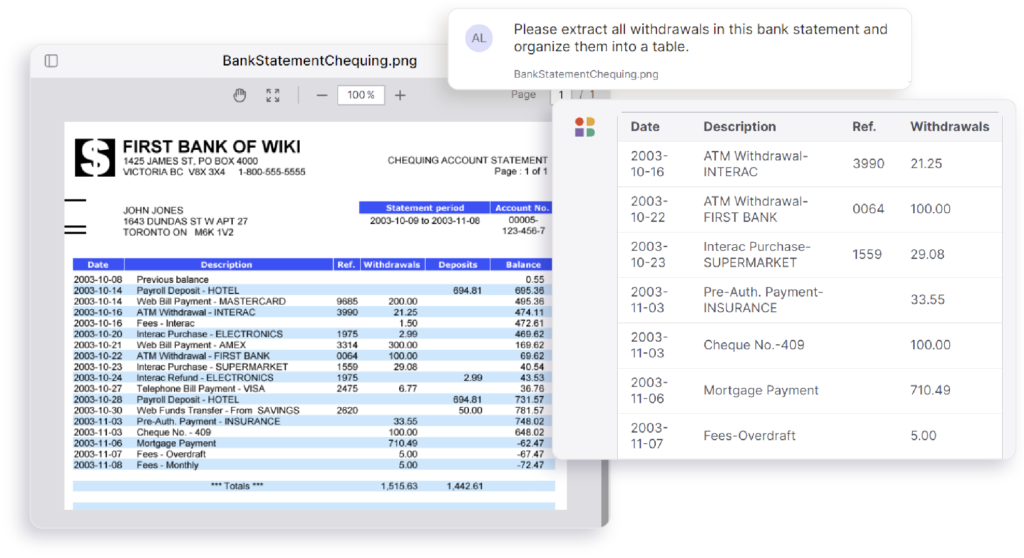

Within the suite of applications in the AI Hub, the Converse app makes it easy to extract data from a bank statement. Here’s how:

1. Go to aihub.instabase.com and open the Converse app.

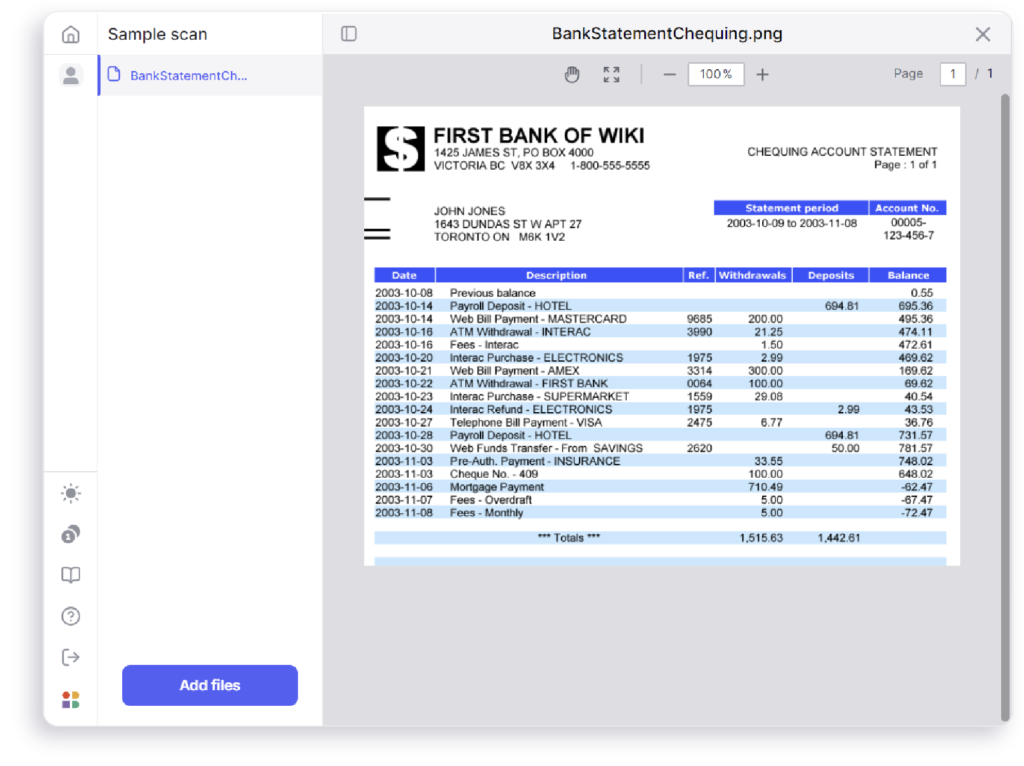

2. Click “Add files” and upload a bank statement (we’re using a PNG file in this example, but you can upload PDFs, Word, Excel, and other file types).

3. Using the chat box in the bottom-right corner, tell Converse the data you’d like to extract. In this example, we asked Converse to extract all withdrawals and organize them in a table.

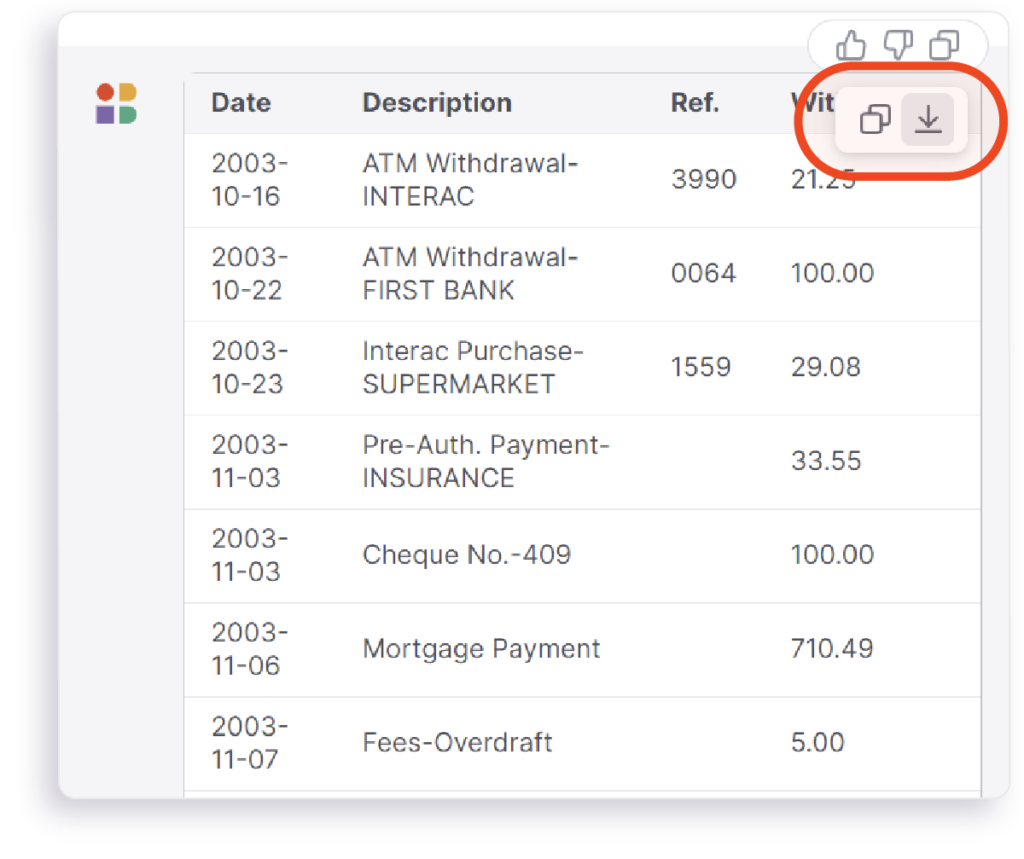

4. Export the data in the format of your choice by clicking on the arrow pointing down, or copy and paste the data by clicking on the icon of two overlapping squares.

Instabase addresses some of the top challenges companies face when using OCR to capture data from bank statements:

- Bank statements are highly variable: Since Instabase uses AI and not templates, it can extract all types of data from semi-structured and unstructured documents.

- Bank statements might contain multiple currencies or languages: Instabase recognizes over 160 languages and can convert currencies.

- Some bank statements may contain handwriting: Not all OCR technologies can recognize handwriting or convert handwriting into text with precision, but Instabase recognizes handwriting — even in multiple languages.

- Bank statement processing requires a high level of security and privacy: Instabase is trusted by some of the largest financial services companies, like NatWest and Standard Chartered.

Get started with Instabase for free and see how you can quickly, accurately, and securely process bank statements for your business.

Bank Statement OCR the Easy Way

Try Instabase AI Hub for faster, better bank statement processing.