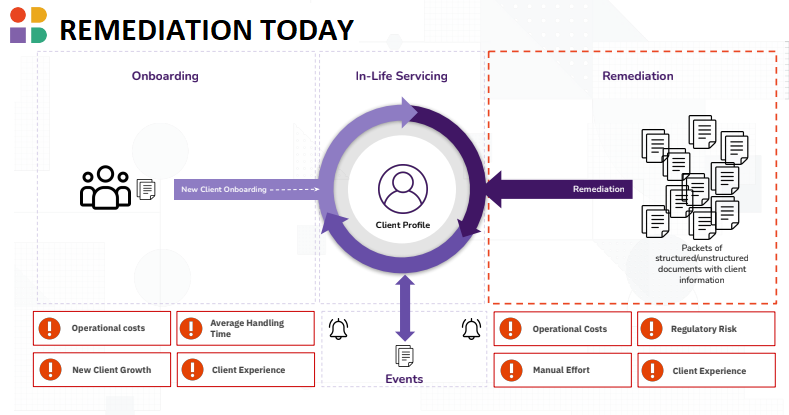

Financial institutions must constantly ensure that they remain free from money-related illegality, including but not limited to money laundering, corruption schemes, and terrorism financing.

That’s why Know Your Customer (or KYC) remediation is so important, and why banks must have efficient, thorough, and clearly defined remediation processes in place. When new rules are passed or extant mandates are changed, or when a regulator instigates a compliance audit, banks must be prepared — or else risk business-shuttering penalties and fines.

According to Finbold’s Bank Fines 2020 report, total aggregated bank fines reached $14.21 billion in 2020, with the most common violation being anti-money laundering breaches. Some notable fines levied in 2020 included:

- Fines totaling more than $900 million levied against Israel’s largest bank, in part for money laundering involving FIFA

- Fines totaling $386 million and $107 million respectively levied against Swedbank and SEB for lacking sufficient AML governance and controls

- Fines totaling $47.45 million levied against the London branch of Commerzbank for inadequate AML systems and controls

To better manage risk associated with non-compliance, financial institutions can embrace technologies that streamline compliance processes. Intelligent automation software offers a means of creating a scalable client due diligence remediation solution. A top-tier intelligent automation platform can provide the building blocks for a financial institution to create a bespoke remediation process that ensures regulatory compliance. Here are some of the top ways such tools can support a bank’s KYC remediation strategy.

Intelligent Automation Eliminates Backlogs

As the ‘back book’ of the client onboarding process, client due diligence remediation can involve tremendous amounts of documentation. In the absence of document understanding software and an automated process for the large-scale review and approval of various forms (account mandates, sanctions reports, various government notifications), a bank can easily find itself with decades’ worth of documents in multiple, incompatible formats located in numerous file storage systems across the organization.

That’s problematic from a remediation standpoint because it means the bank may not even know exactly what information it has and what it still needs to locate to remain compliant.

“Regulators are saying the banks need to know exactly what documents they have and … tag them,” Tom McCann, of Instabase, said. “They’ve got these millions and millions of pages of documents that are all sitting in cold storage or scanned in different systems” and they have a deadline by which they must provide the required information out of them — or face steep fines.

One Instabase client, a large Commercial Bank, had 20 years of accumulated client documentation — to the tune of 200 million pages — through which it needed to sift on a tight deadline.

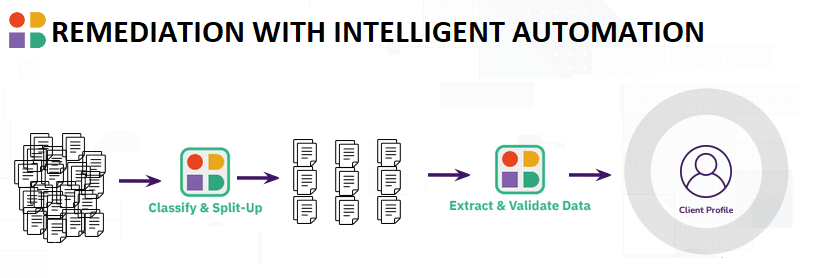

The bank turned to Instabase for an automated process to get it through the backlog. The Instabase Platform automated a number of tasks that would have been virtually impossible for humans within the timeframe needed, including understanding structured, unstructured and semi-structured documentation, identifying and resizing required signatures, splitting up document packets, and integrating everything into the bank’s existing systems.

Intelligent Automation Leads to Fewer New Hires

Thanks to the breadth and depth of work taken on and done by the Instabase Automation Platform, this bank client didn’t have to hire armies of new personnel to achieve remediation readiness by its deadlines. Other financial entities faced with a similar situation have a similar choice, according to McCann.”They either can hire hundreds of people to process manually, or hire 10 and use Instabase,” he said.

It’s no secret that manual work is subject to human error. Yet many banks continue to leave themselves more open to such mistakes. In 2020, one large Australian bank found itself on the wrong side of the law when it failed to comply with various anti-money laundering laws. According to the bank, a major cause for that failure was human error.

Intelligent Automation Leads to Speedier Compliance

Using an intelligent automation platform will do more than improve accuracy with the use and time of fewer employees, however. Perhaps most importantly for banks with looming remediation deadlines, intelligent automation can help the organization achieve compliance far sooner, ensuring they avoid financial and regulatory penalties.

Working with Instabase, the banking client mentioned previously was able to wade through more than 80 distinct classes of documents and map 320,000 customer profiles, all in less than three months.

Let Instabase Help You Maintain Compliance

Leveraging the Instabase Automation Platform enables financial institutions to import documents from multiple disparate sources, split up, classify, and extract pertinent information from large packets, and then integrate that information into existing business systems for easy retrieval and analysis. Better yet, Instabase does all of this at scale, meaning that organizations never have to worry about how to manage fluctuating remediation needs. Find out today how Instabase helps clients achieve smooth scaling in client due diligence remediation.

Client Due Diligence Remediation at Scale.

Automate client due diligence processes with Instabase.